Main Author: Noah Goldberg, GeoInvesting Analyst

Tecogen Inc. (NYSE:TGEN) produces cogeneration products and other natural gas engine products that lower energy costs relative to electric utilities. It also has a subsidiary, ADGE, that engages customers in long term energy production contracts for cogeneration products. These products are currently sold in the United States and Canada. Here is a history of GeoInvesting’s coverage on TGEN:

- On December 7th, 2020 – we offered a brief reason for tracking note

- On January 15, 2021 – we added the stock to our disclosed longs list

We generally do not like to invest in companies that can be impacted by variables that are highly unpredictable. In the case of TGEN, it’s possible that the demand for its products could decrease if natural gas prices materially rise relative to electric rates. However, we do like some of the aspects of TGEN that we think investors will gravitate to, including clean energy and marijuana grow house “cards.”

On the flip side, the company’s business has been negatively impacted by delays in project work due to COVID-19 and we don’t have color on when this risk will dissipate.

Quick Facts – As of 02/23/2021

|

Share Information

|

|

Close Price

|

$1.85

|

|

MCAP (m)

|

$45.97 Million

|

|

EV (m)

|

$48.06 Million

|

|

Shares (Basic) (m)

|

24.85 Million

|

|

Shares (Diluted)(m)

|

24.85 Million

|

|

Trading venue

|

OTCQB

|

|

Financial YE

|

December 31

|

|

Key Metrics

|

|

TTM Revenues (m)

|

$31.31

|

|

P/S (x)

|

1.47

|

|

EV/S (x)

|

1.54

|

|

TTM EPS ($)

|

-$0.10

|

|

TTM P/E (x)

|

N/A

|

|

Current ratio

|

2.76

|

|

Short- term debt

|

$0.2 Million

|

|

Long – term debt

|

$1.66 Million

|

|

BV per share

|

$0.86

|

|

Tangible BV per share

|

$0.59

|

|

Business Activity

|

|

Description

|

Energy Cogeneration

|

|

CEO

|

Benjamin Locke

|

|

Headquarters

|

Waltham, MA

|

|

Website

|

https://www.tecogen.com/

|

|

Catalysts & key risks

|

|

Potential Catalyst

|

Product Line Momentum, Geographic Expansion

|

|

Risks:

|

Low Growth, High Gas Prices, Low Electric Prices

|

Brief History

In 1987, Tecogen was spun out of Thermo Fisher Scientific (NASDAQ:TMO). The company focused its efforts on electric cogeneration products. These products take advantage of low natural gas prices to generate energy that’s less expensive than a traditional electric bill. The company was sold off to a private group of investors in 2000, including George Hatsopoulos and Board of Director John Hatsopoulos.

In 2017, TGEN merged with American DG Energy, an energy production company. ADGE’s customers enter into long term contracts with no upfront costs, where ADGE provides cogeneration products and has customers pay for their energy use.

Business Units

Power Generation

Tecogen produces cogenerators, refrigeration devices, chillers, and heat pumps. These products all use natural gas to lower the cost of heating and cooling relative to using electricity from the grid. These products are designed primarily for residential (apartment buildings) use and commercial use in spaces that have continuous power generation (like indoor growing operations).

Cogeneration: uses a natural gas-fuelled engine and wasted heat to generate electricity. Electricity is fed into the building, thereby reducing the facility’s electrical consumption and utility bill significantly.

“In practical terms, what cogeneration usually entails is the use of what would otherwise be wasted heat (such as a manufacturing plant’s exhaust) to produce additional energy benefit, such as to provide heat or electricity for the building in which it is operating. Cogeneration is great for the bottom line and also for the environment, as recycling the waste heat saves other pollutant-spewing fossil fuels from being burned.”

Refrigeration: a natural gas engine-driven refrigeration device that’s used for industrial refrigeration applications

“Industrial refrigeration can be defined as the equipment and accessories projected to remove heat from large-scale processes or materials, lowering the temperature to a desired value. Depending on different parameters like the production scale, temperature difference, accuracy or expected temperature, there are multiple methods used to apply industrial refrigeration.”

Chiller: a natural gas engine-driven device that circulates chilled liquid through equipment

“A chiller uses a vapor compression mechanical refrigeration system that connects to the process water system through a device called an evaporator. Refrigerant circulates through an evaporator, compressor, condenser and expansion device of a chiller. ... The refrigerant returns to a liquid state at the condenser.”

Heat Pump: takes the naturally occurring energy from the environment (low temperature) and with mechanical work of a compressor, pumps this heat to higher temperature using a standard vapor compression refrigeration cycle

The production segment’s economics are based on selling natural gas devices that are slightly more expensive than their electric counterparts, but reduce annual costs associated with power generation. This makes them especially important for areas with high electricity costs. Generally larger cities are likely to have higher energy bills and electricity costs are steadily increasing every year. Natural gas prices have stayed constant over the last decade. If this trend persists, the potential savings from using cogeneration products should continue to grow.

Tecogen has fitted all their products with the same engine to increase economics of scale and installation efficiency which also allows the company to easily add product lines.

The other two revenue segments are services and energy production.

Services

After selling the natural gas related products, the products need regular maintenance at set time intervals. Tecogen has 11 service centers that perform maintenance and set up for these devices. The revenue is a recurring base because all devices need oil changes, spark plug changes, filter changes, and occasional engine changes on a regular basis. This platform aspect of the business allows the company to run its maintenance service operations more smoothly since technicians at service locations only need to deal with one platform.

Energy Production

When Tecogen acquired ADGE in 2017, it gained an energy production business segment that installs natural gas-based energy generation devices in buildings for no cost and has customers pay to use the energy. These agreements typically last 10 to 15 years. They promise the customers a lower cost than traditional electric bills and maintain the equipment for free. Although some of this work has been historically profitable, prior to the acquisition, ADGE had some contracts with customers that were not optimally priced and were loss making. Tecogen has been selling off some of these lower quality contracts to private investors and is now making recurring revenue by servicing the equipment involved in the contracts. The energy production segment is relatively small now, but will be getting more attention moving forward.

Inflection Point

Tecogen’s CEO, Benjamin Locke, who arrived in May, 2013, has made many structural improvements that we believe has set it on course for becoming a consistently profitable company. It has changed how it markets its products and services, increased its product line, and has expanded its geography.

In the past Tecogen was in an inbound engineering sales environment. When a customer needed a product, they would contact Tecogen directly. This was an inefficient system because it relied on customer outreach, which led to limited amounts of new customers. Tecogen has started to focus on direct sales in addition to engineering sales. Additionally, the company is partnering with natural gas companies to find new customers. Natural gas companies are incentivized to market Tecogen products, because new Tecogen customers will lead to higher sales of natural gas.

Tecogen has also expanded its product line. In 2019 it created a gas-engine driven refrigeration compressor, and more recently it has worked on expanding its sales for Ultera emissions technology. Prior to Benjamin Locke taking over as CEO, there were many products that Tecogen had created that weren’t being marketed or sold. Locke took advantage of Tecogen’s technology and expanded its product offering by marketing some of its other devices.

Moat

Some of the products that they’ve more recently started to focus sales efforts on has no direct competitors. Tecogen is the only company to offer a natural gas-based chiller. Originally York was offering a similar product, but dropped out of the market. The chiller could provide significant upside as they attempt to grow the market for the device.

The Ultera technology brings natural gas engines into compliance with California’s air quality standards. Fuel cell technologies and Ultera technologies are the only technologies that comply with California’s air quality standards.

Source: Tecogen’s 2020 10-K

Given the recent issues with electric utilities causing fires in California, and more recent power outages, there’s a strong demand for off grid power generation devices. We believe that Tecogen is in a unique position to sell congenators fitted with Ultera technologies to California residents and businesses.

Tecogen is actively working on expanding its geographic reach by opening new service centers and patenting its technology in European countries. In March of 2020, Tecogen opened its most recent service center in Toronto as it saw demand grow in the area. Also, in January 2020, it received patents in 19 EU countries for its Ultera technologies. This opens the opportunity for Tecogen to license Ultera in the EU and take advantage of new environmental regulations taking place in the area.

Besides Tecogen’s demographic expansion, it also is focusing more heavily on being involved in indoor marijuana growing which appears to be rapidly a gaining legal footing across the U.S. A year ago, the number of states that had legalized recreational marijuana 9. Now 15 states have legalized recreational marijuana, and many others are working on legislation. Tecogen has products in cannabis cultivation centers in Massachusetts, Nevada, and New Jersey. Growing marijuana indoors requires a substantial amount of energy, which makes Tecogen a complimentary service for growing operations. Growers can reduce energy related costs by over 50% by using TGEN’s solutions.

“Our products are well-suited to meet the needs of the rapidly emerging indoor agriculture market, including cannabis. To date our focus in the indoor agricultural market has primarily involved cannabis, a product with high revenue generating potential. However, we have sold to other indoor agricultural growers, and we believe that the indoor food production market will provide significant opportunities for the Company. The indoor agriculture market in particular has the potential to be a major driver of growth as states move to legalize the use of cannabis for medicinal purposes and recreational use.”

Financials

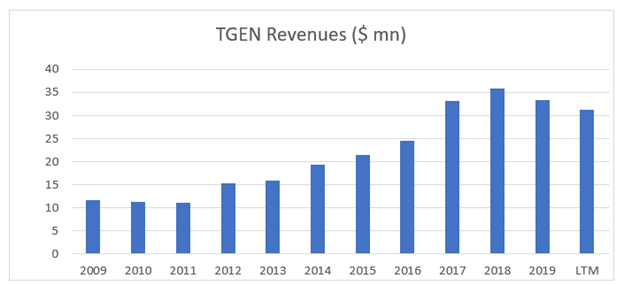

Revenues have been steadily increasing over time, but have been in a downtrend over the past couple of years. We believe that the expansion of the energy production segment, TGEN’s entry into Europe, and its increased selling of Ultera technologies can continue the increase in sales momentum after COVID-19 dissipates.

From a cost perspective, we see variability in selling expenses and increased salaries contributing to variability in G&A. That being said, a large amount of TGEN’s cost base is fixed and that gives it a high degree of operating leverage. Assuming Tecogen can continue to grow revenues, we anticipate it becoming profitable in the next couple of years.

Caveats

- The stock has risen sharply in 2020, up over 150% since July 2020

- Its products are valuable assuming natural gas prices are lower than electricity costs. So, there is a bit of unpredictability in the business than we normally like to accept

- The stock is illiquid

- Future potential regulations on fossil fuels could cause problems for the company

- Project delays by customers being impacted by COVID-19

- Current CEO has had some history of dilution with past companies

Valuation

We think that TGEN offers a compelling valuation for a company reaching inflection in its profitability. With a enterprise value of $45 million, there’s a real possibility that TGEN can make $10 million in net income in 2025 or $0.40 EPS. With limited competition and a growing market, we think TGEN has the potential to be a multibagger in the long run and provide near term gains as well.