Retractable Technologies Inc. Coverage History Timeline

- March 2019 Premium Member Tweet

- We issued a premium tweet, stating that we were going to take a deeper look into the company, due to heavy insider buying activity by the CEO

- September 2019 Premium Member Morning Email

- Company reported strong Q2 results

- We noticed that the CEO had been aggressively buying stock for a long period of time, including 400k shares over the last six months

- Announces settlement of multi-year lawsuit with Becton, Dickinson And Company (NYSE:BDX)

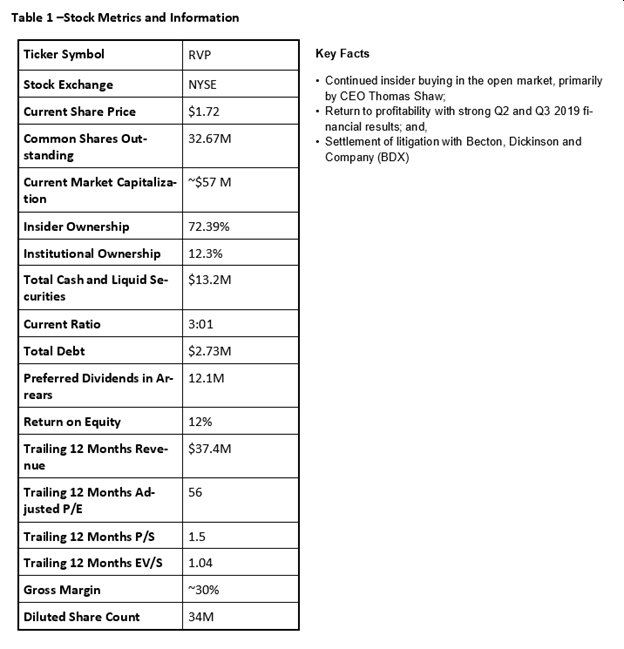

We believe the growth and profitability outlook Retractable Technologies, Inc. (NYSE:RVP) contain significant risks and unknowns. Our unsuccessful attempts to speak with management are also an impediment to fully understanding the risks associated with an investment in RVP. However, at an enterprise to sales multiple of ~1.2x, RVP is selling well below EV/S multiples of other medical device companies in our coverage universe that sport EV/S multiples well north of 4x. Thus, we placed a small bet on the stock, just in case the positive growth trends and developments that have occurred over the past 6 months continue. However, please be aware that we do not consider RVP to be a high conviction holding.

A “timely” risk we need to consider is RVP’s ability to manufacture its products in light of the coronavirus, putting stress on the ability of Chinese companies to operate (at least as reported by the media). As of 2018, RVP’s:

“Chinese manufacturers produced approximately 85.3% of our products. In the event that we become unable to purchase products from our Chinese manufacturers, we would need to find an alternate manufacturer.” 2018 10K, Page 5

Q4 2019 Results, which we estimate will be released at the end of March, could help shed some light on many of the questions we still have about RVP’s growth prospects.

Brief History

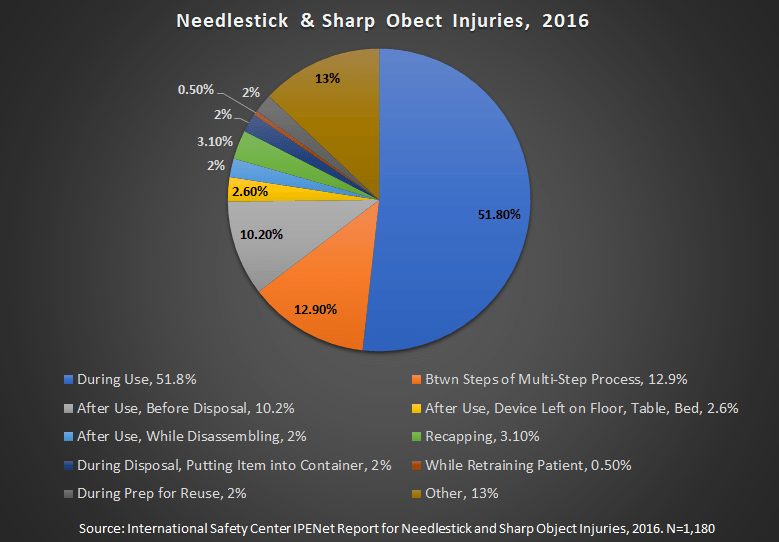

Retractable Technologies, Inc. (RVP) designs, manufactures and markets safety needle devices for the healthcare industry. More specifically, RVP’s needle solution aims to reduce needlestick injuries, cross-contamination through reuse, and disposal costs.

Needlestick injuries are wounds caused by needles that accidentally puncture the skin. Needlestick injuries are a hazard for people who work with hypodermic syringes and other needle equipment. These injuries can occur at any time when people use, disassemble, or dispose of needles

The Company has been in business for over 20 years and appears to offer best in class and more affordable needlestick solutions than its comps:

“Our price per unit is competitive or even lower than the competition once all the costs incurred during the life cycle of a syringe are considered. Such life cycle costs include disposal costs, testing and treatment costs for needlestick injuries, and treatment for contracted illnesses resulting from needlestick injuries.

EasyPoint® retractable needles offer unique safety benefits not found in other commercially available safety needles. Manually activated safety needles that compete with EasyPoint® must be removed from the patient, exposing the contaminated needle prior to activation of the manual safety mechanism. EasyPoint® needles allow for activation of the automated retraction mechanism while the needle is still in the patient, reducing exposure to the contaminated needle and effectively reducing the risk of needlestick injuries. EasyPoint® retractable needles are compatible with Luer-fitting syringes, including pre-filled syringes. In addition, EasyPoint® retractable needles may be activated with fluid in the syringe, making it applicable for aspiration procedures such as blood collection.”

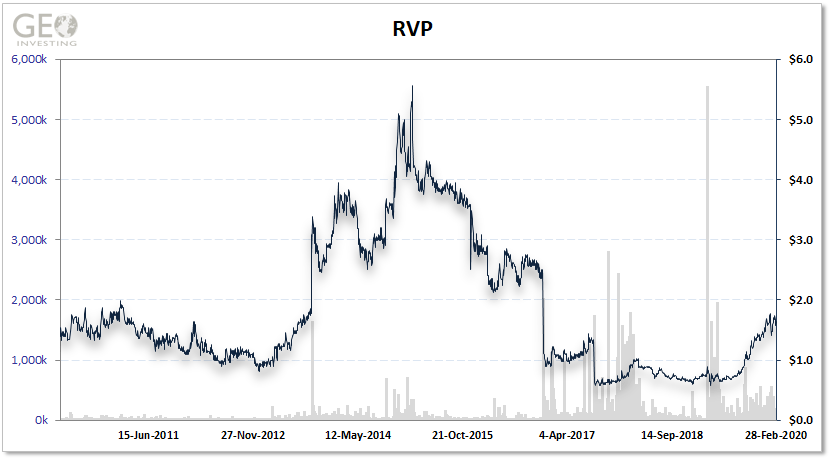

Despite what appears to be RVP’s clear product offering advantage, it has struggled to gain market share as larger rivals, like Becton, Dickinson And Company (NYSE:BDX), have used competitive tactics to limit wider adoption of RVP syringes by hospitals and physicians. For example, revenue has been pegged at around $30 million since 2008.

Bullish Thesis

Retractable Technologies is a medical device company led by an innovative founder who continually buys stock in the open market. Recent strong financial results may be an indication that the company is capturing market share, which is necessary for the stock to sustain long-term gains. However, the company has experienced spurts of growth in the past that did not stick. We are curious to see if the recent end of a multi-year legal battle with BDX, where BDX was found to have violated antitrust laws, will help the company capture market share and free up resources, allowing it to focus on growing its legacy business and embarking on new product initiatives. Furthermore, the U.S. regulatory environment has been increasingly calling for healthcare providers to reduce needlestick related injuries.

Please note that our multiple attempts to interview management have been unsuccessful, but we will keep trying. In the meantime, we wanted to give you some insights into the company.

As of 2/28/2020

Is Sales Growth Here to Stay?

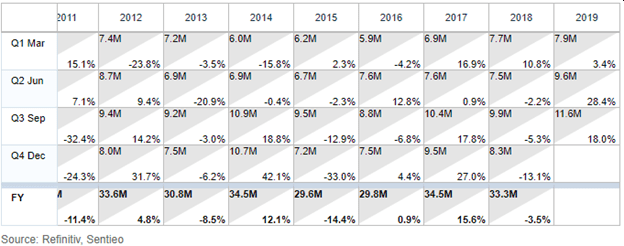

Although the company has posted no revenue growth over the past decade...

… it has put together back to back quarters of growth, posting strong results in Q2 and Q3 2019.

During Q2 2019, same period sales increased 31%, resulting in sales of $9.5 million vs. $7.4 million. The Company reported quarterly earnings per share of $0.01 compared to -$0.03 per share in the prior year.

During Q3 2019, same period sales increased 15.8%, resulting in sales of $11.6 million vs. $9.9 million. The Company reported quarterly earnings per share of $0.03 compared to -$0.01 per share in the prior year.

It should be noted that Q3 is typically the best quarter for the Company as a result of healthcare providers preparing for the flu season.

Industry

According to the current analysis of Reports and Data, the disposable syringe market had an estimated value of $7.10 billion in 2018, and with a CAGR of 5.6% is projected to reach USD $11.00 billion by 2026. The global syringes market size is expected to reach $25.7 billion by 2026, expanding at a CAGR of 8.5%, according to a new report by Grand View Research, Inc.

The report addressed the outlook for retractable syringes:

“Global Auto Disable Syringes Market is expected to an estimated value of USD 22.29 billion by 2026 registering a healthy CAGR of 10.45% in the forecast period of 2019-2026. This rise in the market can be attributed due to rising number of needle stick injuries and increasing R&D activities related to auto disable syringes.”

The main advantage of the Company’s products include protection from needlestick injuries, prevention of cross contamination through reuse, and reduction of disposals and other associated costs. Needlestick injuries are not only a risk for people who regularly administer needles. The following infographic, adapted from the CDC website, shows when needlesticks occur:

In November 2000, the Occupational Safety and Health Administration (OSHA) set new standards to address needlesticks:

- Modify the definition of "engineering controls" and adds definitions for the terms "sharps with engineered sharps injury protection" and "needleless systems,"

- Requires employers to consider and implement new technologies when they update their "exposure control plan,"

- Requires employers to solicit employee input with respect to appropriate engineering controls, and

- Requires employers to maintain a sharps injury log.

Similar measures have also been taken globally. In 2002, the World Health Organization (WHO) estimated that 2 million people are exposed to needlestick injuries. While needlestick injuries have decreased over time, as of 2017, The American Journal of Infection Control estimated that:

“ more than 300,000 healthcare workers in the United States suffer sharps injuries (such as needlesticks) annually. The article is the most recent of a series of articles published over the past few years (several of which were published in the AOHP Journal). The data shows that the number of sharps injuries has remained essentially unchanged over the past several years.”

However, it appears that another 300,000 go unreported per year. The number of needlestick injuries outside the U.S. is estimated to be about the same.

WHO also estimates that:

“40% of the 16 billion injections are administered by reused injection equipment every year, causing millions of infections among patients.”

Finally, in 2010 the EU:

“adopted Directive n. 2010/32/UE to prevent sharp-related injuries (needlestick injuries included) requiring public and private health care facilities to evaluate and provide safety devices for their workers, and to use safety needles and other devices designed to prevent needle-stick injuries.”

Our research indicates reported needlestick-related injury costs in the U.S. have risen from $3000 per case in 2013 to $5000 per case today. This works out to cost the U.S. healthcare system over $1 billion, annually. So, the problem is still very significant.

Something else to monitor is the funding some cities are setting aside to distribute free needles to drug users through needle exchange programs.

“Needle exchange programs are controversial harm reduction programs that provide sterile needles to people who inject drugs. Many programs also dispose of unsterile needles and provide an array of other services. The goal of the programs is to reduce the transmission of diseases, such as HIV and hepatitis C.”

For example, San Francisco just budgeted $15 million for this purpose. Since the goal of these programs is to reduce the transmission of diseases, it’s possible to contemplate a scenario where retractable syringes could eventually become part of these programs.

The majority of decisions to purchase medical supplies are made by Group Purchasing Organizations (GPOs) as opposed to interaction with the actual end users (nurses, doctors, and testing personnel).

“GPOs often enter into contracts with large manufacturers which can limit entry into the marketplace by small competitors, such as RVP.” Source: RVP SEC Filings

Competitors

RVP Competitors include Becton, Dickinson And Company (NYSE:BDX) and Medtronic Plc. (NYSE:MDT), large and well-funded public companies with market capitalizations of over $63 billion and $124 billion, respectively. BDX and MDT control the majority of the U.S. syringe market and have safety needle solutions that compete with RVP’s products. International competitors mentioned in the company’s filings include Terumo Corp. (OOTC:TRUMF), Smiths Group Plc (OOTC:SMGZY) and B. Braun Medical Inc.

It should be noted that BDX and RVP have had a long history of litigation between one another. In 2015, RVP was awarded $340 million, affirming their position that BDX had engaged in anticompetitive conduct to maintain its monopoly. This award came after Retractable Technologies, Inc. (NYSE:RVP) took home $107 million between 2004 and 2007. The more recent $340 million judgement, along with improving financial results in 2013 and 2014, resulted in a 400% rise in the Company’s shares over two years (2013 to 2015 from ~$1.00 to ~$5.00). Subsequent to poor financial results and an appeal by BDX, the Company’s shares reverted back to a range of around $0.60 to $1.00, before recently rising to hit a high of $1.79 after the company reported strong 2019 Q2 and Q3 financial results, as stated above.

The litigation between BDX and RVP was recently settled and resulted in both parties dropping counter litigations with no payments made out to either company, including the $340 million judgement. RVP contended that BDX used unfair competitive practices aimed at GPO. Here are excerpts from RVP’s filings detailing the litigation:

“In May 2010, our and Mr. Shaw’s suit against BD in the U.S. District Court for the Eastern District of Texas, Marshall Division alleging violations of antitrust acts, false advertising, product disparagement, tortious interference, and unfair competition was reopened. Tyler Division, and the jury found that BD illegally engaged in anticompetitive conduct with the intent to acquire or maintain monopoly power in the safety syringe market and engaged in false advertising under the Lanham Act. The jury awarded us $113,508,014 in damages, which was trebled (triple) pursuant to statute. The Court granted injunctive relief to take effect January 15, 2015 including, among other things, a requirement to notify certain customers and others regarding misleading disclosures.

A district court judgment in 2015 awarded us approximately $340 million ($113 times 3) in antitrust damages from BD and the Fifth Circuit affirmed a finding of false advertising liability against BD. However, in connection with BD’s subsequent appeal, on December 2, 2016, the United States Court of Appeals for the Fifth Circuit overturned the antitrust damages. The finding of false advertising liability was affirmed and the case was remanded to the Eastern District of Texas for a redetermination as to the amount of damages to which we are entitled. On August 17, 2017, District Court for the Eastern District of Texas issued the Court’s Final Judgment ordering that we take nothing in our suit against BD and dismissing the case. We filed a notice of Appeal with the United States Court of Appeals for the Fifth Circuit on November 3, 2017. Oral arguments occurred on October 3, 2018. On March 26, 2019, the U.S. Court of Appeals for the Fifth Circuit issued an opinion affirming the District Court’s take nothing judgment.

Effective May 3, 2019, we settled and released all past claims against BD and MDC in return for a settlement and release of past claims against us from BD and MDC. On May 6, 2019, filings were made with the U.S. Court of Appeals for the Fifth Circuit to cease further proceedings in our antitrust and false advertising suit against BD and in the U.S. District Court for the Eastern District of Texas to dismiss BD and MDC’s suit against us for patent infringement.”

As part of the settlement, patent infringement claims brought against the company by BDX and MDT were also dropped.

“In September 2007, BD and MDC Investment Holdings, Inc. (“MDC”) sued us in the United States District Court for the Eastern District of Texas, Texarkana Division, initially alleging that we are infringing two U.S. patents of MDC (6,179,812 and 7,090,656) that are licensed to BD. BD and MDC seek injunctive relief and unspecified damages. We counterclaimed for declarations of non-infringement, invalidity, and unenforceability of the asserted patents.”

What we find most interesting is that even though RVP was not awarded the $340 million judgment, the courts still concluded that BDX violated antitrust laws. So, we think it’s possible that BDX might make the decision to lessen or stop its deceptive marketing practices. Given that it looks like RVP claims it has better solutions than BDX, such a scenario could lead to sustained growth and possibly the company being an acquisition target, provided it can continue to protect its patent position.

In the most recent quarterly results (Q3 2019), the Company announced it had filed a lawsuit (No. DC-19-17946) against Locke Lord, LLP and Roy Hardin in connection with their legal representation of the Company during past litigation proceedings against BDX, alleging that Locke Lord, LLP and Roy Hardin breached their fiduciary duties, committed malpractice, and were negligent in their representation. This is somewhat worrisome as it’s a distraction that could take away focus from growing the company.

Products and Revenue Streams

RVP’s key products include:

- VanishPoint Syringe (85% or revenue), sold from as far back as 1997

- PatientSafe Syringe (5%), sold since 2008

- EasyPoint Needle (10%), Sold since 2016

The domestic vs. international revenue mix has been roughly 8% to 20% over the past several years. EasyPoint was introduced in 2016 to address some of compatibility issues VanishPoint had with commonly used winged (butterfly) needle sets and luer adapters. VanishPoint and EasyPoint can be used for injections and blood collection, and for intravenous (we still require further clarification), subcutaneous, intradermal and intramuscular injections.

RVP’s needles:

“are automatically retracted directly from the patient into the barrel of the syringe when the plunger handle is fully depressed and while the needle is still in the patient. The pre-removal, automated retraction virtually eliminates exposure to the contaminated needle, effectively reducing the risk of needlestick injury.”

A useful video on YouTube goes into depth on how to use VanishPoint. A more concise clip is below: https://drive.google.com/file/d/1qcGBcXwJ3GKNCD6xZeujru73Zq1KnN1q/view

We are still attempting to find a complete video that highlights how PatientSafe works, but you can view this following clip for a bird’s eye view: https://drive.google.com/file/d/19_1D5Hc976n7Isgc2O1xKGpgkxSL8SOI/view

We like that EasyPoint’s retractable mechanism can be activated before or after the syringe is removed from a patient. You can see this here or watch the clip below: https://drive.google.com/file/d/143lYaLsPTzloLFbndlzPNnII2MLHifUZ/view

This is important, since due to habit, some healthcare practitioners may prefer to remove the needle before activating retraction. However, activating retraction with in the patient reduces the risk of blood splatter.

Refer to the Company’s website (https://retractable.com/Resource_Center) for a complete library of videos and more information on the benefits of the Company’s products.

Other safety products RVP is working on include:

- More retractable needles and syringes

- Glass syringes

- Dental syringes

- IV catheter introducers

- Additional blood collection sets

We will need more time, but we have started assessing competing safety syringe solutions. Old style safety syringes, otherwise known as retrofitted syringes, “offer protection through a feature that appears to be added on.” For example, some safety mechanisms use a shield or other covers that are manually activated to cover the exposed needle. See video demonstrations by BDX, MDT , TRUMF, and Dynarex.

In our opinion, these solutions are not even close to RVPs.

“Manually activated safety needles that compete with RVP must be removed from the patient, exposing the contaminated needle prior to activation of the manual safety mechanism. RVP Needles allow for activation of the automated retraction mechanism while the needle is still in the patient.” Source: Various RVP Filings

Statements in their filings clearly point to RVP believing that they have the best retractable syringe product.

“EasyPoint® retractable needles offer unique safety benefits not found in other commercially available safety needles. Manually activated safety needles that compete with EasyPoint® must be removed from the patient, exposing the contaminated needle prior to activation of the manual safety mechanism.” Source: Various RVP Filings

We believe the same “unique safety benefits” also exist with VanishPoint. Here is a video from RVP, highlighting inferior solutions that rely on safety mechanisms after the needle is removed from a patient,

Given that most needlesticks occur shortly after a needle is removed from the patient, RVP would seem to offer a first-class solution, especially EasyPoint, due to its versatility.

“Speaker Notes: Injuries with needles and other sharp devices can happen at any time during use. NaSH data show that the majority of injuries occur during or immediately after use; 15% occur during or after disposal. During use injuries often occur when the device is being inserted or withdrawn and/or the patient moves.”

When we look at the competitive landscape for retractable syringes, we found plenty of companies that market syringes, where the syringe is retracted into a barrel, manually or by pressing a button after the needle is removed from the patient:

For reasons we have already discussed, we consider the above solutions to be inferior to RVP’s. We had hoped that RVP was the only inpatient retractable solution in town. This might have been the case at one time, but does not currently appear to be the case. We came across competing retractable solutions where the removal of a needle can occur while it’s still in the patient, similar to VanishPoint and EasyPoint:

- VanishPoint Characteristics

- Injection and blood collection

- Retraction can be activated only outside a patient

- Retraction activated by depressing top of syringe

- EasyPoint characteristics:

- Injection and blood collection

- Retraction can be activated while needle in or outside a patient

- Retraction activated by depressing side of syringe

And here are some characteristics of competing products:

- Sure Safe

- No Video, so unsure if retraction can be activated after needle is removed

- injection and blood collection

- Could not fully compare retraction mechanism to RVP, since no video. However, retraction appears to occur while needle is in patient

- Retraction activated by depressing to of syringe

- Q stat automatic Syringe, 1:30 and 2:25 time stamp

- Injection and blood collection

- Retraction mechanism seems inferior to RVP

- RETRAGO, marketed in Italy

- Retraction is activated while needle is only in the patient

- Blood collection is not mentioned in Video or website

- Unsure if can be used for blood collection

- Retraction mechanism seems to be on par with RVP

- Retraction activated by depressing top of syringe

- BD Vacutainer UltraTouch

- Retraction is activated while needle is only in the patient

- Only for blood collection

- Butterfly injections

- Retraction mechanism seems to be on par with RVP

- Retraction activated by depressing top of syringe

- BDX BD Integra, 3:40 time stamp

- Can’t be used for blood collection or venipuncture

- Retraction can be activated while needle in or outside a patient**

- In patient retraction mechanism seems to be suboptimal compared to RVP

- Retraction activated by depressing top of syringe

**The ability of EasyPoint retraction to be activated in or outside a patient seems significant, but the BDX Integra also carries this function. However, EasyPoint can be used for injections and blood collections, while it appears that the Integra can only be used for blood collection. Furthermore, we like that EasyPoint retraction is activated by depressing the side of syringe, which avoids pushing the needle into the patient with activation methods that occur from depressing the top of the syringe.

Before we make a more definitive assessment of how RVP’s products stand up against the competition, we have several more tasks to consider:

- Interview management

- Gain a better understanding of the differences between VanishPoint Syringe, PatientSafe and EasyPoint

- Obtain a much broader sampling of competitors and their products

- Interview competitors

- Interview GPO

- Can competitor solutions cover as a wide a spectrum than it appears RVP’s can be used for?

- (blood collection and types of injections)

- The ability of RVP vs. competitor solutions to limit blood splatter risk

- Do healthcare practitioners prefer to retract syringes while the syringe is out or in the patient?

- Learn more about the BD butterfly (BD Integra) retractable solution and its limitations of use

- Regarding RETRAGO

- Does RVP’s patent protection prevent RETRAGO from being marketed in the U.S.

- Is RETRAGO marketed outside Italy

- Does RETRAGO limit RVP’s ability to compete outside the U.S.

- Gather more intel on competitive solutions that exist outside the U.S.

- Compatibility of company syringes with all sorts of needles

Regardless of the positive takeaways we have on RVP’s products, it’s hard to argue against the reality that the competitive landscape could be vast. Will other vendors’ existing customers see RVP’s product advantages as enough reason to make the switch to RVP? It’s tough to say. There is no doubt that needlestick injuries have declined markedly over the years. On the flip side, the amount of needle stick injuries is still large and the decline of injures has flattened out, maybe making the case that the demand for in-patient retractable solutions, like RVP’s, will increase.

Patent Risk

A GeoInvesting Premium Member sent us an article from September 2016 that dug deep into the RVP vs. BDX battle. It actually appears that BDX concluded that RVP’s products were superior and intended to copy them once their patents expired:

“In their appeal filings, Retractable’s lawyers pointed out that testimony showed BD planned to sell low-cost retractable syringes and dominate as much as 70 percent of that market as soon as Retractable’s patents began expiring in 2015. As early as 2007, a BD project team had concluded that while Retractable was “weak” financially, its intellectual property position was “strong” until 2015, when the 20-year patents protecting its chief product would expire.”

Key patents for the Company’s syringe products will expire in 2020, allowing competitors to potentially copy formerly proprietary design elements of the Company’s syringe products. That being said, after 2020, the Company will still have active patents in its portfolio, covering future modifications/improvements to its syringe products that won’t expire until 2028 through 2032, provided that the VanishPoint® syringes are modified to incorporate the modifications covered in the unexpired patents. “RVP also has other patent applications covering inventions applicable to the VanishPoint® syringe which are pending.” We find it encouraging that it looks like RVP was able to extend its patent protection, much like it did in 2015 when they were able to extend the protection by 5 years to 2020.

Feedback from Nurses

Even though we believe that RVP’s technology may be better than most or all of the competition, we have and will continue to perform research to see if it truly has “best in class” marks, including interviewing healthcare personnel to see what they think about the products.

Here is what we have found, so far:

Nurse 1

I just watched the videos. The IV needles that I use at work are retractable. We get some pre-filled syringes with medication that are retractable as well. As far as the (retractable) “butterfly” needles for withdrawing blood samples, we started using them at Bryn Mawr. Frequently they would retract when I pulled the cover off the needle before I stuck the patient. So that would be a wasted needle. I believe there was also a problem with the design because they sometimes did not give blood despite clearly being in the vein.

The last video used some interesting scare tactics (see here). The (non-retractable) needle being used to inject medicine directly into the arm has a plastic pink sleeve that folds over the used needle. No one that I know puts their hand anywhere near the needle to fold the sleeve over the needle. That is bad practice. Good practice is to use the bedside table to fold the safety sleeve over the needle. There is no way to be stuck, personally, when used this way. Nurses are always looking for a way to make their practice easier and more efficient. Hospitals must always take cost into account. For every dollar a hospital spends on supplies, that is a dollar less in our paychecks.

Nurse 2

I talked to my friend who used to be a clinical manager, for Becton Dixon. She would instruct on how to use their IV products. She liked the syringe with the (RVP) snap back needle, price is key. VanishPoint is different and likes EasyPoint. She is curious if blood splash is an issue.

Corporate and Capital Structure

Thomas J. Shaw, a mechanical and structural engineer, is the founder and CEO of RVP. He controls over 50% of the common shares and has continued to aggressively accumulate shares in the open market. (Mr. Shaw began to aggressively purchase additional shares in the open market starting in 2017). In addition, the Company has a license agreement with Mr. Shaw which requires the Company to make quarterly payments to the CEO amounting to 5% of gross sales.

The Company’s manufacturing and administrative facilities are located in Little Elm, Texas. During 2018, approximately 14% of the medical devices were manufactured at the Texas facilities with the remainder being outsourced to manufacturers in China. Outsourcing the majority of manufacturing has enabled the Company to increase manufacturing capacity at a competitive cost while outlaying little additional capital.

However, with $12.1M of preferred dividends and $2.73 M of debt outstanding, investors should be aware that dilutive equity raises remain an ongoing risk for the Company. Moreover, in the event of a significant share price increase, holders of the Company’s convertible preferred debt may be incentivized to convert their preferred debt into common shares, diluting existing common shareholders.

On a positive note, it appears that RVP does not plan to raise new capital through dilutive equity raises:

“At the present time, Management does not intend to publicly raise equity capital. We have sufficient cash reserves and intend to rely on operations, cash reserves, and debt financing, when available, as the primary ongoing sources of cash. Our ability to obtain additional funds through loans is uncertain.” (Source: Q3 2019).

Catalysts

Lawsuit - Settlement between RVP and BDX removes some uncertainty and may allow management to refocus attention on growing the business. However, the recent lawsuit filed against its lawyers, Locke Lord, LLP and Roy Hardin, may temper this possible outcome.

Growth - Sales and earnings growth in Q2 and Q3 2019 is encouraging and, assuming strong financial results continue, may result in increased interest by investors, resulting in valuation multiple expansion and/or a higher share price. It’s unclear if any of the sales growth is coming from a possible abatement of negative marketing tactics from BDX.

New Growth Avenues

International Growth - Over the last 4 years revenue generated outside the U.S. has ranged from 10% to 20%. We would like to know if the competitive landscape outside North America is less restrictive, creating an untapped growth opportunity for RVP.

Alternate Care Market – “We continue to pursue various strategies to have better access to the hospital market, as well as other markets, including attempting to gain access to the market through our sales efforts, our innovative technology, introduction of new products, and, when necessary, litigation. Although we have made limited progress in some areas, such as the alternate care market, our volumes are not as high as they should be given the nature and quality of our products and the federal and state legislation requiring the use of safe needle devices. The alternate care market is composed of facilities that provide long-term nursing and out-patient.” Source: Various RVP Filings

Regulatory Environment - New regulation could surface since needlesticks are still a huge cost to the healthcare system, even after technological advancements and a wider adoption of safety syringes.

Insider Buying - CEO Thomas Shaw continues to buy shares in the open market. He has purchased ~3 million shares since the beginning of 2017.

Risks

Financial Inconsistency - Management has not yet demonstrated the ability to consistently grow sales and maintain profitability.

Arrears - There are currently 12.1M in preferred dividend arrears. Management’s plan on addressing this outstanding liability is unclear and may result in equity raises, potentially diluting existing common shareholders.

Patents / R&D – As we stated earlier, key patents for the Company’s syringe products will expire in 2020, but RVP still has active patents in its portfolio covering future modifications/improvements to its syringe products that won’t expire until 2028 through 2032, provided that the VanishPoint® syringes are adapted to incorporate the modifications covered in the unexpired patents. Still, we would like to gain some more clarity on patent risk.

On a related subject, at 1% of sales, the company is barely spending any capital on research and development. We would like to see R&D to be running at least between 5% to 10% of sales, especially since the company has about $13.2 million in cash and cash equivalents. One possible reason for the low R&D spend could be that the CEO plays a big role in new product development.

Competition – RVP has been public for nearly 20 years and continues to struggle to gain significant traction in the market for its key products, likely due to BDX’s anticompetition practices. The Company’s main competitors are typically much larger, well-funded and have proven successful in limiting the market penetration of RVP’s products.

Control by CEO – CEO Thomas Shaw holds complete control of the Company, owning over 50% of common shares outstanding. Moreover, his motivations behind his continued buying of common shares in the open market remain unclear. It is possible that Mr. Shaw is simply reinvesting a portion of the quarterly royalty payments (5% gross sales) he receives from the Company to gain further control of the Company. However, we can’t ignore that he is still betting on the company, even as the stock continues to move higher.

U.S. – China Tariff War: RVP manufactures 85% of its products in China, but it does not look like their products have been exposed to this risk:

“We are subject to risks associated with foreign trade policy. In 2018, we used Chinese manufacturers to produce 85.3% of our products. Trade protection measures, including tariffs, and/or changes to import or export requirements could materially adversely impact our operations. As of the date of this filing, syringes are not included among the Chinese products on which the U.S. has proposed tariffs. We cannot predict the impact of potential changes to U.S. foreign trade policy.”

Coronavirus - Other risks to consider include the recent coronavirus. The pandemic may be a benefit or a risk depending on how it plays out. India recently blocked exports of healthcare related personal protection equipment like masks and hazmat suits. In the event of widespread vaccinations, other countries may consider implementing similar actions which may have significant impacts on the Company’s ability to deliver its products to customers. On the other hand, if blocking exports of syringes does not occur in Asian countries, the coronavirus may be a boon opportunity for the Company.

Also, we need to ponder the inability of RVP to manufacture its products since, as of 2018, RVP’s:

“Chinese manufacturers produced approximately 85.3% of our products. In the event that we become unable to purchase products from our Chinese manufacturers, we would need to find an alternate manufacturer.”

Valuation

RVP is trading at a lofty trailing twelve-month P/E of ~55. However, if the company can maintain and build on the profitability it has finally attained, the P/E will come down. We like to place more weight on price to sales or enterprise value to sales when valuing medical device companies. RVP Is currently trading at an EV/S of 1.04 compared to EV/S well north of 4 for growing medical device companies in our coverage universe. Given RVP’s lack of consistent growth, the low P/S and EV/S are possibly justified. Furthermore, at ~30%, gross margins are well below those of what we consider Tier One medical device companies that sport gross margins of at least 70%. However, major upside could be in the cards if management can find a way to grow.

Conclusion

Although there are clear advantages in the Company’s products when compared to other products in the market, management’s inability to gain significant traction in the market over the last 20 years could lead to a conclusion that RVP is a risky investment and highly speculative. Thus, we are being somewhat cautious about investing in RVP, as it has yet to demonstrate its ability to execute and achieve long term consistent profitability. Furthermore, it certainly appears that BDX has a line of safety needles that offers retraction options, possibly a reason that RVP has been unable to grow revenue.

However, new regulation and a possible softening of deceptive marketing tactics from bigger competitors could signal that a growth inflection point is on the horizon. Since RVP is selling at a modest EV/S, we are willing to place a bet on the stock. Securing an interview with management will remain a near-term goal.

About the Authors

Andrew Vermeer

Andrew is an avid micro-cap investor in the Canadian markets and is pursuing a career in the finance industry by pursuing the CFA charter as a CFA Level III Candidate. Andrew lives in the KW Area of Ontario, Canada and loves to uncover investment opportunities by analyzing overlooked companies not covered by main street analysts.

Tom Birnie

Tom has been a private investor for over 19 years. He has experience in technical, quantitative, and fundamental analysis. Tom holds a degree in Mechanical Engineering from Queen’s University at Kingston, Ontario. https://twitter.com/100BaggerHunter

Maj Soueidan- Co-founder, GeoInvesting

Disclosures:

- Andrew Vermeer – no position

- Tom Birnie - no position

- Maj Soueidan - Long RVP