By Maj Soueidan, Co-founder GeoInvesting

Banking that government mandates for adoption of new aircraft identification technology will help reignite growth in sales and lead to higher margins.

| Conviction statement: To be clear, we only hold a speculative position in the Tel-Instrument Electronics Corp (OOTC:TIKK) since, at this time, the Company’s long-term growth outlook is unclear to us. We believe the company will experience growth in the near term as it helps its government customers meet new equipment upgrade mandates. Beyond that, the company has to prove that its new plan to drive consistent and profitable revenue growth will be successful. |

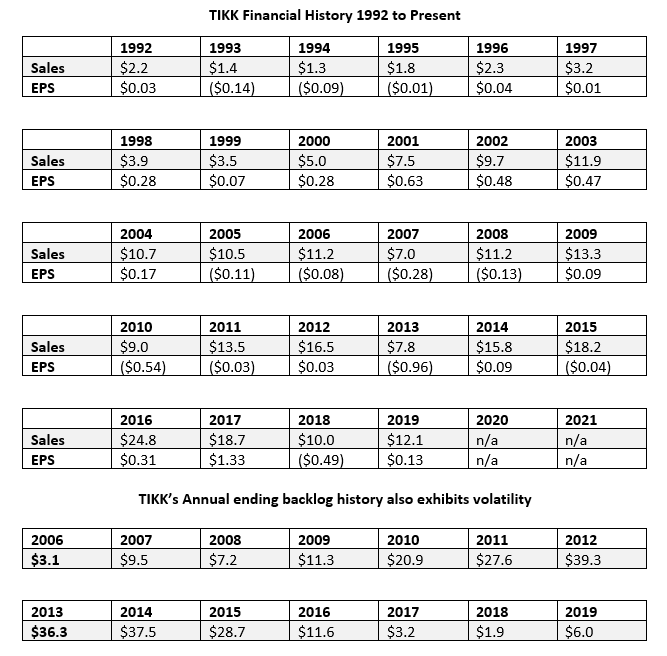

Laced with a history of overpromising and underdelivering, I put TIKK on the do not buy bucket several years ago. I was unimpressed by the Company’s inability to maintain revenue growth and profitability. Its on-and-off-again government business and wide range of product prices ($10,000 to $90,000) are partly to blame for this inconsistency.

However, the Company snuck its way back onto our radar when it posted back to back year over year growth in Q3 and Q4 2019 (year ends in March), perhaps a sign that its recent growth initiatives, designed to drive more consistent growth, are working.

Then, as luck would have it, the NYSE-AMEX delisted TIKK from its exchange on March 11, 2019, due to its failure to meet the minimum shareholder equity listing threshold, due to a $5 million loss reserve it established as a result of an adverse legal judgement related to a multi-year trade secret legal battle with its primary competitor, Aeroflex. TIKK is appealing the decision. On that same day, the stock fell from $3.60 to $2.55 after hitting a high of $5.80 in response to strong Q3 numbers released on February 8, 2019.

Over the past couple of years, a few members have asked GeoInvesting to take a look at TIKK. Based on some new company developments, we decided to finally take a cursory glance at the Company. Even though TIKK is not a high conviction holding for us, we think it might be helpful to understand the new direction management is trying to take the Company.

TIKK History and Cursory Fundamentals

TIKK has been around since 1947 and completed its public offering in 1988. TIKK manufactures and markets a variety of portable aerospace test equipment for global commercial and government customers. Its test products are used by its customers to make sure navigation and communication equipment are functioning properly before “lift off.” TIKK’s instruments are used on the flight line (“ramp testers”) and in the maintenance shop (“bench testers”). A typical test kit can be seen below:

TIKK currently sells four commercial products and twelve military products.

For its defense business, the Company acts as a subcontractor, meaning it is awarded contracts from prime defenses contractors who work directly with the U.S. department of defense (DoD), like Lockheed Martin Corporation (NYSE:LMT), $RTN and $BAESY.

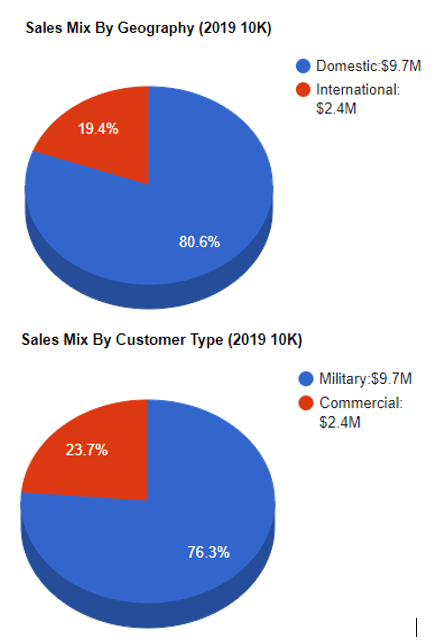

Here is a breakdown of the revenue by geography and type of customer as of TIKK’s 2019 year ending in March:

SEC.gov provides TIKK’s financial information dating back to 1992. Revenue bounced around $1.5 to $2.5 million between 1992 and 1996. Then, the Company went on a profitable 7 out of 8-year run, with sales topping out at $11.9 million in 2003. In general, TIKK’s financial history is characterized by several multiple quarters of growth, followed by multi-quarter declines in sales and earnings. These runs coincide with government contract cycles and TIKK’s new product introductions.

Based on our research, we are not anywhere close to concluding that TIKK will deliver consistent long-term shareholder returns. We also would need to understand more about what type of edge the Company may have over its competitors, which could be its claim that many of its test kits offer an all in one solution. Furthermore, the Company has worked closely with the Navy to develop products, beating out its major, much larger competitors, when bidding on significant contracts. We are also impressed that the Company is developing some new modern all in one test kits.

“…multifunction testers have made it easier for customers to perform ramp tests with less operator training, a fewer number of test sets, and lower product support costs.”

Another competitive advantage the Company claims to possess is that there are a limited number of competitors who are qualified to bid on some of the projects they bid on. To TIKK’s credit, it has been able to secure large contracts over its lengthy operating history, but like many other small defense subtractors, it has been unable to sustain growth.

We would like to see if new product introductions and a regulatory technology upgrade deadline are setting TIKK up to enter one if its growth uptrend cycles. Beyond that, we want to track TIKK to determine if management has found a way to position the Company for sustained long-term grow by broadening its presence across the military, while aggressively expanding its commercial offering.

Quick Facts:

- Head Quarters: East Rutherford, NJ

- CEO: Jeffrey O’Hara

- Number of Employees: 41

- Price - $3.61 (As of Dec 4, 2019)

- Insider Ownership: 27.3%

- P/E of 8.8

- EV/S of 1.1

- Shares Outstanding: 5.1 million

- Market Cap: 18.4 million

Reasons for Tracking Tel Instruments Electronics

1. Some Consistency Has Arrived

TIKK has put together 4 consecutive quarters of sales and earnings growth. However, notice the variability in EPS from Q2 2019 to Q2 2020, bringing into light the lumpiness we highlighted earlier.

- Q2 2020

- Sales of $3.9 million vs $2.2 million

- EPS of $0.13 vs loss of $0.06

- Q1 2020

- Sales of $3.3 million vs $1.8 million

- EPS of $0.08 vs loss of $0.23

- Q4 2019

- Sales of $4.1 million vs $2.1 million

- EPS of $0.17 vs a loss of $0.25

- Q3 2019

- Sales of $4.0 million vs $$2.6 million

- EPS of $0.17 vs loss of $0.07

- Q2 2019

- Sales of $$2.2 million vs $1.8 million

- Loss per share of $0.06 vs loss per share of $0.23

2. Regulatory Mandates

Investor optimism has centered around one of TIKK’s main products it has been selling since 2007: test equipment serving the Identification Friend or Foe (“IFF”) flight line market. TIKK Is banking that upgrades in IFF technology and government mandates for adoption of this new technology will help reignite growth in sales and lead to higher margins.

“IFF (Identification Friend or Foe) is the military designation of the Air Traffic Control (ATC) System that is used to identify and track military aircraft.” The IFF system consists of an airborne transponder and a ground (or airborne) interrogator. The system measures the distance and heading to the aircraft, and the transponder encodes identification and position information into the response. IFF Mode 5 is the most recent implementation of the system.”

The Navy uses modes to coincide with technology related to various communications operations.

- Mode 1 is a nonsecure low cost method used by ships to track aircraft and other ships.

- Mode 2 is used by aircraft to make carrier-controlled approaches to ships during inclement weather.

- Mode 3 is the standard system also used by commercial aircraft to relay their positions to ground controllers throughout the world for air traffic control (ATC).

- Mode 4 is secure encrypted IFF (the only true method of determining friend or foe)

- Mode "C" is the altitude encoder.

A major short coming of Mode 4 is spoofing or tricking transponders that encode identification information. Mode 5 was the answer and became the upgrade to Mode 4.

Mode 5 is a military-only identification mode, which modifies the existing Mark XIIMode 4 IFF (referred to as “Mode 4”) system and addresses known shortcomings of the legacy Mode 4 identification.

We learned that the development of Mode 5 technology commenced in 1995, but it took time for U.S. prime contractors to create equipment that would be Mode 5 compliant. TIKK has been providing Mode 5 capable test kits since 2007, beating out its competition to become the first company to provide Mode 5 test equipment to the U.S. Navy. We came away from a recent interview with management with the understanding that the Company may have exploited most of its low hanging Mode 5 conversion IFF opportunities in the U.S. with its large installed base of Mode 4 test equipment within the military.

While the Company is introducing new test kits and software for the U.S. military, the Company is banking on its international business to provide it with near-term growth. This stems from a mandate that will require the U.S. military and Allied countries to adopt Mode 5 technology by 2020. The first time this mandate showed up in TIKK’s SEC filings was in its 2007 10K, where it mentioned that Allied forces would have to adopt Mode 5 technology by January of 2020. The “sunset” date is now July 2020. The Defense Security Cooperation Agency (DSCA), a division of the United States Department of Defense, provides:

“financial and technical assistance, transfer of defense material, training and services to allies, and promotes military-to-military contacts. Security Cooperation (SC) is founded on a tradition of cooperation between the United States and other sovereign nations with similar values and interests in order to meet common defense goals. It consists of a group of programs authorized by the U.S. Foreign Assistance Act of 1961, as amended, and the Arms Export Control Act, as amended, and related statutes by which the DoD or commercial contractor provide defense articles and services in furtherance of national policies and objectives.”

A website associated with the DSCA discussed the transition from Mode 4 to Mode 5:

IFF systems are sensitive devices that emit signals used to identify whether a platform is friendly or unknown to help prevent fratricide. IFF Mode 4, part of the Mark XII system, was designed in the 1950s to provide a secure military IFF capability. Mark XII IFF Mode 4 system will remain operational until 2020, when it will be replaced by the Mark XIIA IFF Mode 5 system. IFF Mode 5 is will utilize new or upgraded interrogators and transponders, as well as new cryptographic devices (either embedded or external). The IFF Mode 5 provides improved performance with new higher capacity waveforms, a modern cryptographic algorithm and processor, optional asynchronous position reporting, and time-dependent authentication. Mark XIIA Mode 5 waveform is the future standard for all military transponders and interrogators. Nations may utilize a mixed Mode 4 and Mode 5 operational environment until Mode 4 expiration in 2020. Both Mark XII IFF Mode 4 and Mark XIIA IFF Mode 4/5 systems are considered significant military equipment (SME). IFF transponders/interrogators also include civil air traffic control (ATC) modes, which do not require COMSEC to operate.

So, what does this means for TIKK? Planes that don’t adopt Mode 5 technology will remain grounded. Since, according to the Company, the U.S. Military has basically replaced Mode 4 with Mode 5, the growth opportunity lies with the Allied forces. The company and investors had hoped that the monetization of this this international opportunity would have been greater than it has been, so far. But apparently, our allies were not as quick to adopt Mode 5 and have waited until the final hour to make the shift. The company has delivered test kits to 18 international markets, including Germany, under a procurement contract that is expected to span seven years. Overall, according to SEC filings, TIKK believes that they have a three-year opportunity to capitalize on the international scene.

Unfortunately, management was not able to provide us with the dollar-estimate of international market. That is something we would have to dig into further. But we believe it may be significant, although less when compared to the U.S. market.

Aside from the Mode 5 conversion play, TIKK still gets orders from selling its test kits to new domestic and global government programs outside its installed test kit base. For example, the Company has been receiving orders from the Joint Strike Fighter (JSF) program for a few years, and the program seems to be heating up:

“Twelve countries have committed to orders of the F-35 joint strike fighter either as formal partner nations or through foreign military sales. As production of the fifth-generation systems ramp up, the joint program office and manufacturer Lockheed Martin are looking to expand their global footprint even further. More than 390 F-35s are currently in the global fleet, Winter said. That number will swell to nearly 500 by the end of 2019. Production will ramp up as operational testing concludes in the fall of 2019 and the program enters full-rate production. To prepare for increased quantities, production experts from across the United States government are working with our industry partners to deliver quality parts on time and at affordable costs,” he said. “To achieve efficiencies, the program has incorporated a number of performance initiatives and incentives across the entire supply chain to support F-35 production lines in Italy, Japan and the United States.”

Overall, the Company experienced a healthy flow of defense-related orders over the last year. Its contracts like one they received from Germany could help give revenue longer-term sustainability:

“We have received an initial purchase order for our TS-4530A IFF Test Set totaling $520,000 from our European Distributor, Muirhead Avionics (“Muirhead”) for Mode 5 test sets from the contract awarded by the German military. This is a seven-year procurement contract with anticipated orders for the 2019 calendar year of approximately $3.5 million in total.”

3. New Commercial Product

Defense revenue has made up the majority of the Company’s recent revenue, and it is marketing and developing new modern test equipment for its military markets.

However, TIKK sees a large opportunity to steal market share from Aeroflex, its main competitor in the commercial market. The commercial aviation market consists of approximately 80 domestic and foreign commercial airlines. The general aviation market:

“consists of some 1,000 avionics repair and maintenance service shops at private and commercial airports in the United States that purchase test equipment to assist in the repair of aircraft electronics.”

The current commercial product lineup has a narrow focus, which is why the Company has been developing a new commercial product (SDR/OMNI), which are close to being released.

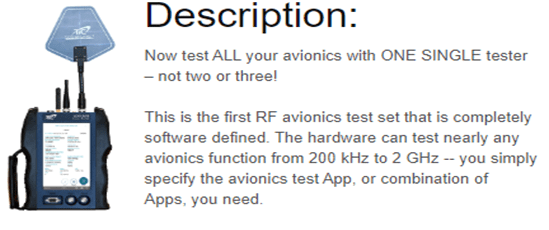

“The world’s first “All-in-One” Avionics Test Set utilizes true software-designed radio technology that enables it to test all common avionics functions in one 4.5-pound test set.”

This is the first commercial product the Company has introduced in ten years. TIKK claims it will be the smallest and lightest test kit on the market. Furthermore, the Company claims SDR will be much more technologically advanced (ability to work with more frequencies) than its current testing solutions to the point where it can be an all-in-one option for a wide variety of tests. It also claims that it can even open the door to new markets within the military, like homeland security (secure communication radio test market), where the Company sees a $300 million opportunity.

Even more interesting is that the product is being designed as a hardware/software platform, so it becomes a scalable test solution where upgrades can occur through the installation of software and APPs, as opposed to customers having to continue to replace hardware if test kits become obsolete. This adds convenience for its customers and should lead to significant cost savings for them. The Company’s initial focus will be to introduce SDR to the commercial market, followed by the defense market. However, it looks like TIKK may be a year away from bringing SDR to market.

For comparison purposes, notice the different structure of TIKK’s typical test box:

TIKK is hoping that increased exposure to the commercial avionics market will relieve it of some of the contract lumpiness risk that is inherent in the defense market and give the Company a chance to experience more consistent growth. However, it’s no guarantee that TIKK will be successful in going up against established competitors. As far as the defense market goes, TIKK is going to have convince its customers to shell out money for SDR, after just buying Mode 5 kits. An excerpt from TIKK’s recent 10K discusses SDR.:

“The Company is finalizing its new handheld avionics flight-line Test Set, the “SDR-OMNI”. The world’s first “All-in-One” Avionics Test Set utilizes true software-designed radio technology that enables it to test all common avionics functions in one 4.5-pound test set, which is half the weight of competitive test sets. The SDR/OMNI has very wide frequency to accommodate new commercial and military waveforms. It utilizes the latest touch screen technology and has the capability to replace all TIC commercial test sets with one handheld product. The initial SDR-OMNI software release will provide test capability for Transponders (Modes A, C, and S), ADS-B, and 978 MHz UAT capability for the large general aviation test market. This release is targeted at the civil aviation market that is subject to the January 1, 2020 requirement for ADS-B out test capability. This will allow us to compete with the IFR 4000 and 6000 test tests for our commercial aviation and military customers. The next software release will incorporate Nav/Comm test functions which can be purchased as APP’s by our customers. The SDR-Omni product is a game changer in the commercial avionics test market as it will allow customers to replace multiple competitive test sets with one unit that is smaller and provides more capabilities at a fraction of the cost. It has also been designed to allow TIC to penetrate the secure communications test market which is considerably larger than our core avionics test market. The much larger growth potential is in the secure military and homeland security radio test market which is many times the size of our existing avionics test market.

The commercial avionics industry is undergoing a great deal of change and we believe our new lightweight, hand-held products that we are planning to introduce towards the end of calendar year 2019 will generate increased market share at very attractive gross margin levels. The technology for the hand-held product will provide a platform for future products. This new technology provides us with the opportunity to expand out of our relatively narrow avionics test market niche and enter the much larger secure communications radio test market. We are actively working to secure partners to enter this growth market and we believe that our new hardware platform provides unmatched capabilities in a market leading form factor. TIC is also evaluating upcoming customer test set requirements and expects at least one large competitive solicitation will be issued in the next 12 months for a product in our technical area of expertise. We are also working closely with our other military customers on new potential market opportunities that will be needed to maintain our sales and profitability growth.”

4. Information Arbitrage (InfoArb)

Due to management’s propensity to miss the mark on some of its goals, we are taking information arbitrage findings with a grain of salt.

Some are worth pointing out, given that the Company is attempting to transition its business to a more predictable business model. For those of you who are new premium members of the GeoInvesting platform, our definition of InfoArb is

“An information arbitrage exists when a disconnect between stock prices and available public information on a company is noticeable, and monetarily worth pursuing.”

Financial InfoArb

Recall earlier, that we mentioned TIKK was the first company to be awarded a Mode 5 test order contract from the U.S. Navy in 2009. Apparently, one of the competitors also bidding for the project was Aeroflex, with revenues of around $500 million at that time. After TIKK was awarded the project, Aeroflex contested TIKK’s contract win and eventually sued the Company. Aeroflex claimed:

“…that the Company and its two employees misappropriated Aeroflex’s proprietary technology in connection with the Company winning a substantial contract from the U.S. Army, to develop new Mode-5 radar test sets and kits to upgrade the existing TS-4530 radar test sets to Mode 5 (the “Award”). Aeroflex’s petition, seeking injunctive relief and damages, alleges that in connection with the Award, the Company and its named employees misappropriated Aeroflex’s trade secrets; tortiously interfered with Aeroflex’s business relationship; conspired to harm Aeroflex and tortiously interfered with Aeroflex’s contract. The central basis of all the claims in the Aeroflex Action is that the Company misappropriated and used Aeroflex proprietary technology and confidential information in winning the Award. In February 2009, subsequent to the Company winning the Award, Aeroflex filed a protest of the Award with the Government Accounting Office (“GAO”).”

Without going into too much detail, the Company won the first battle when the Kansas District Court dismissed the suit on jurisdiction grounds. However, Aeroflex still took the matter to court in Kansas and, through a jury trial, prevailed on multiple fronts. TIKK had to pay $4.9 million in total damages, but is appealing the decision, a process which will take several years.

“The Company filed its Motion to Conventionally File Appellant’s Opening Brief under Seal Along with an Electronically Filed Public Redacted Version on February 21, 2019 and filed its Response to Order to Show Cause on February 26, 2019. The Court entered an Order setting the Prehearing Conference for March 5, 2019. The Prehearing Conference took place as scheduled and the Court entered an Order memorializing the conference on March 13, 2019. In the Order the Court appointed a Court Security Officer, allowed the parties to file private un-redacted briefs only available to the Judges and necessary court staff and redacted public briefs. The private briefs were due on March 27, 2019 with redacted briefs due 45 days following the filing of the private brief and extending all briefing page limitations by 10 pages. The Company filed its private brief on March 22, 2019. Aeroflex filed its response in July 2019.”

We are not banking on TIKK winning on appeal. In any case, the Company has a window to generate cash to offset a potentially negative decision:

“Our attorneys estimate that it will take several years for this appeal to work its way through the Kansas court system, but that ongoing future legal expenses will be nominal. We believe that we will have approximately two to three years to generate sufficient cash or secure additional financing to support the repayment of the remaining $2.9 million plus accrued interest not covered by the $2 million appeal bond, if we do not prevail with the appeal.”

It's worth noting that as of Q2 2020, TIKK’s cash balance stood at $4.2 million:

“Our near-term goal is to continue strengthening our balance sheet and set-aside sufficient cash reserves to fully discharge the Aeroflex damage award in the event that we are unsuccessful with our pending legal appeal. We are well on our way to achieving this milestone with cash balances hitting $4.25 million at September 30, 2019.”

Some financial information arbitrage stems from the reason why the NYSE delisted TIKK. The reason given by the exchange was that the Company did not meet a minimum shareholder equity standard of $4.0 million. At the time of the delisting, the Company had reported negative equity of 1.4 million, but said it would be able to meet the requirements by the end of 2019. From that statement, we can assume that the Company should be able to have at least four million dollars of equity by the end of 2019. Since its current equity is at around $100,000, management’s assumption would result in the Company accumulating substantial earnings per share (1.00).

Given that management has missed the mark in the past, we are not putting too much weight on the timing of meeting the $4.0 million threshold. In fact, as of September 30, 2019, shareholder equity was only $722,444. Also, multiple avenues exist that could lead to the Company experiencing an increase its shoulder Equity, besides through an increase in net income, such as:

- Writing down liabilities

- Offering shares but the Company made the following statement

SEC Filing Narrative InfoArb

We took a look at the 10Ks and 10Qs for 2017, 2018 and 2019 to see if we could find any information arbitrage clues. Specifically, we wanted to determine if management sentiment has become more bullish when referencing the most recent 10K and 10Q and if that information is not present in press releases.

The following commentary is new 10K verbiage:

"All Allied countries have a drop-dead date of July 1, 2020 for Mode 5 capability so this international business has started to accelerate this year and we expect it to remain strong for at least the next three years. We will continue to actively market our products to all of the major international customers. Our expectation is that we will continue to improve both our revenues and gross margins."

The following commentary is no longer in the 10K:

"Our expectation is that we will significantly improve both our revenues and gross margins starting in the 2019 calendar year, but because the timing of these new orders is largely out of our hands, we expect to see continued volatility in our quarterly revenue"

The following is important verbiage related to a product function that was referenced in 2018 and 2019 that references recurring revenue:

"The Company has also developed a Remote Client LabVIEW program for the CRAFT, TS-4530A, and T-47/M5 products and we have seen solid interest is this product. The Remote Client LabVIEW program will be used by TIC customers in both manufacturing and engineering environments. The software application allows for remote control of the unit with a print-out of all test results. It is expected that its primary application will be for Mode 5 and ADS-B certification testing. We believe that this product will be a source of recurring high margin profits in the years ahead. This software should also assist in the sale of Mode 5 test sets due to the added functionality provided."

We also looked for examples to illustrate how the Company sometimes misses the mark or has been regurgitating the same bullish commentary in multiple years, with no real progress.

Example of commentary that has been in multiple 10Ks (2018 and 2019) that still has not materialized:

“TIKK is also evaluating upcoming customer test set requirements and expects at least one large competitive solicitation will be issued in the next 12 months for a product in our technical area of expertise.

The Company has built a very solid position in the Mode 5 IFF and TACAN test set market. We believe that we are well positioned as our CRAFT and TS-4530A flight-line test sets have been endorsed by the U.S. military and we have already delivered test sets into 18 international markets. The commercial avionics industry is undergoing a great deal of change, and we believe our new hand-held products that we are planning to introduce in twelve months will generate increased market share at very attractive gross margin levels. We are also working closely with our military customers on new potential market opportunities that will be needed to maintain our sales and profitability.”

Examples highlighting product quality issues and government contract risk from 201310K:

“As previously announced, the Company is forecasting sharply reduced revenues in the first quarter of fiscal year 2013 (period ending June 30, 2012) and a loss due mainly to a temporary hold in CRAFT 708 production shipments to correct issues discovered in prior CRAFT 719 deliveries and incorporate the final AIMS approved software configuration which includes several product enhancements. TIC has also experienced continuing delays in securing a production release on the TS-4530A program from the U.S. Army. TIC has made several management changes to enhance its organizational structure and provide emphasis to the manufacturing stage of the Company’s development as it enters the production phase of its three major programs. The Company is working closely with the U.S. Navy and the U.S. Army to secure production releases on the CRAFT and TS-4530A programs. TIC is still predicting significant revenue and profitability growth for the current fiscal year ending March 31, 2013.

The Company’s legacy products continue to be negatively impacted by weakness in the commercial avionics market and lower than expected government orders. Engineering development for the three new programs has also taken longer than expected due in part to customer required specification changes. These delays have limited sales growth while engineering expense continued to be high as a result of the Company completing the design of the units. “

5. Takeover Candidate

We are beginning to think that TIKK could be an interesting takeover candidate. With its new commercial product, the Company has its eye on stealing market share from commercial competitors. However, it does not appear that many serious players exist. According to the Company:

“The civilian market for avionic test equipment is dominated by two designers and manufacturers, the Company and Aeroflex, Inc., a division of Viavi Solutions, Inc. (NASDAQ: VIAV) (“Aeroflex”), with Aeroflex being substantially larger than Tel. This market is relatively narrow and highly competitive.”

Valuation

This is where it gets a little tough. How do you value a company that has experienced extreme lumpiness in revenue for most of its operating history? So, we are just not ready to make a valuation call at this time, as is the case with many turnaround or new growth initiative stories we monitor or buy into.

We do see the possibility of a short-term pop in the stock if the Company continues to report quarterly financial improvements and continues to land Mode 5 contracts. Based on recent contract wins, this scenario does seem quite possible. However, we are not interested in including TIKK in our Favorite Model Portfolio if it remains a one-trick pony where we will have to ask ourselves, “How will they grow once the Mode 5 low hanging fruit is fully exhausted?”

However, we do concede that considerable long-term upside does exist to TIKK’s current share price if management can accomplish just of one its two major goals:

- Expand its U.S. military business to outside aviation markets

- Successfully penetrate the commercial market

Caveats

- TIKK’s Inability to consistently grow, despite bullish commentary in past press releases and SEC filings, is by far the biggest caveat to a bullish thesis.

- If would be preferable that the Company was able to provide investors with the market opportunity size.

- Product upgrades mandated to be adopted by international customers by July 2020 provides some visibility, but we don’t have clarity on how much of this opportunity the Company has already exploited. The Company already sold test equipment to 18 international countries.

- The Mode 5 sunset date was already moved from January 2020 to July 2020. Will it be moved again?

- The Company needs to provide more clarity on SDR/OMNI pricing model

- Even though TIKK may have a better product for the commercial market, it will still have to displace established commercial competitors.

- We still don’t have a clear understanding of how the Company will pivot from a project type business model.

- It looks like the Mode 5 conversion has a 3-year shelve life. If the Company does not gain traction on its SDR product, revenues could materially fall after Mode 5 conversion has been exhausted.

- Will TIKK’s standing with the government suffer if its appeal fails to reverse the $5 million in damages awarded to Aeroflex?