Altigen Communications, Inc. (OTCQB:ATGN) is a cloud service provider. The company provides software and services for small and medium-sized businesses who require Voice Over Internet Protocol Phone (VoIP) Systems. Many of these businesses use Microsoft Azure to equip themselves with cloud-based solutions. Altigen operates as a logistical middle man for Microsoft Azure customers to implement and customize complicated user interfaces and programs (in this case, specifically for VoIP).

Microsoft’s Azure, a cloud titan, has surged in growth in the past few years. After January’s Q2 earnings announcement, the reaction in Microsoft shares was lukewarm. Microsoft beat the per share number, but investors were not pleased with a slowdown in Azure growth.

How badly did it disappoint? Well, a year ago, Azure grew 98% in Q2. This second quarter, it grew 76%.

That is not bad at all. However, Q1 2019 growth was also 76%. Wall Street is not going to like more “bad” news.

For us, this is no problem. We shift our attention to ATGN, Altigen Communications, Inc. There is no shortage of supply and demand here.

Altigen also provides cloud solutions for call routing and communication systems for businesses, namely “PBX.” PBX means public branch exchange and is the technology used to route phone calls. It is no longer a hardware component.

The Cloud has revolutionized computing. You could have made a lot of money in cloud computing titans Google, Amazon, and Microsoft. You also could have been able to capture the incredible value creation catalyzed by the cloud in companies such as Adobe, who were welcomingly forced into transforming away from hardware.

It can be said that we are in the final stages of the cloud revolution. Hardware will be reduced to the minimum. Margins for technology companies have accordingly risen and the best of them are able to drive recurring revenues. Cloud is a no brainer; in fact, it is a necessity. That is where companies like Altigen come into play.

Integrating and customizing SaaS solutions on cloud platforms is difficult. Businesses must spend time, money, and human capital to implement solutions. The other option is outsourcing a third party to manage the cloud. There is a real pain point here, and the solution is viable.

Also in its own final stages of a hardware-to-software shift, Altigen is one of many service providers for Azure.

What Altigen does is equip businesses – notably those in healthcare, financial services, retail, and business services – with functionality in VoIP. Technicalities aside, what this does, overall, is supply and reduce costs for businesses to make phone calls over the cloud/internet. Think of it as a centralized and externally managed IT department (now without the hardware).

Thesis: Businesses need to begin employing cloud technology for VoIP functions. Those who employ cloud services must dedicate resources to manage complicated technological infrastructure, especially when consulting the cloud titans. Integrating and customizing SaaS solutions on certain platforms – Google Cloud, Microsoft Azure, Amazon AWS – is difficult. Businesses must spend time, money, and human capital to implement solutions. The other option is outsourcing a third party to manage the cloud and VoIP. Altigen is one solution.

Altigen claims to provide the following benefits for business who employ its software (from Altigen 10-K):

- Enhance Productivity – New advanced UC features and functionality enable businesses to better communicate and collaborate to enhance productivity and efficiency.

- Reduce Monthly Communications Costs – Cost-effective SIP Trunking Service and new modes of communication like instant messaging allow businesses to substantially reduce their monthly communications costs.

- Lower Total Cost of Ownership – With no upfront CAPEX investment and a predictable monthly operational expense based on actual utilization, businesses will be able to realize a lower total cost of ownership.

- Simplified Management and Support – With no hardware to deploy, manage and maintain, the support burden on local IT/Telecom teams is greatly reduced.

- Future Proof Solution – As a hosted managed solution, all hardware and software is kept up to date by Altigen, providing an always up to date solution for the enterprise.

*Altigen does not sell hardware anymore. Any handsets are sold through resellers and distributors. Altigen has a mobile application which extends the desktop VoIP onto one's cellphone. The application can be used regardless of cloud platform (Skype or otherwise; Altigen has its own cloud service: MaxCS IP PBX).

The entirety of Altigen solutions can be found in its annual report, pages 9 through 13, and on its website.

Alas, pain points in the free market bring intense competition. Altigen needs to maintain and secure contracts for services and software sales. The rest, at this point, is well taken care of. The company holds an outstanding amount of cash on the books (enough to even weather the storm of over a million in litigation damages, which are almost completely resolved).

Catalysts

Recurring Revenue

- Altigen began its journey into converting the entirety of sales into recurring revenue in 2015. This yields more predictive cash flows, sustainable revenue levels, cost reduction, and scalability. The company is in the final stages of this conversion, but several customers remain on outdated product. For the time being, it works; but soon, Altigen will begin converting the last of such customers. What this means is the customers who still use Altigen’s hardware phones must convert to software and ditch the phones (and conversion means new revenue). Chief Executive Officer Jeremiah Fleming validated this, and it is a matter of time before the remaining customers will need to make decisions. He says about a third of customers have yet to convert.

- Altigen’s newfound profitability is sustainable, despite significant risk in customers’ bargaining power. The company no longer must rely on growth to entice investors. Although Altigen spends significant amounts of money in R&D, EBIT margin is greater than 21% (rare for businesses in this space). A shift into profitability is more than welcome to a high margin and scalable business. Together, this business structure reinvigorates the opportunity for growth and higher profitability. What comes in in the top line can trickle down to the bottom more reliably. It is important to note that gross margin has likely peaked and will stay near 82-84% in the future.

- VoIP services, service support programs (post-contract customer support), and software make up 98% of revenues. All three are now recurring revenue streams, billed either monthly, annually, or every three years.

Growth in Microsoft Azure

Litigation

- The company incurred losses stemming from two significant lawsuits. Damages paid have suppressed the stock price. In recent months the stock has more than doubled, thanks to strong results. The damages have nearly been made whole, and whatever has been left – not much – is sufficiently covered by cash on the books. In fact, the entirety of damages paid would still be covered by cash accounts even today. ATGN trades at a lower multiple relative to competitors; and if you look at its positioning with respect to competitors (below), you will see that once Altigen displays it has put litigation behind and growth ahead, value will be uncovered.

The Altigen bottom line: Altigen is tremendously undervalued

Subtle fundamentals to this business coupled with growth and industry-rare profitability have been overshadowed, but for not much longer.

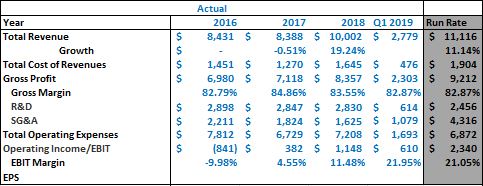

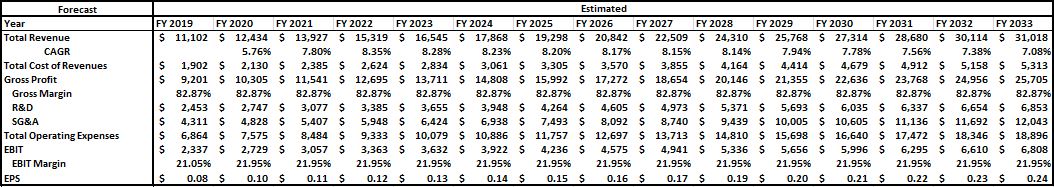

We modeled Altigen to grow at an average CAGR of 7.25% over 15 years, keeping gross margin consistent and ending 2019 with the current run rate. EBIT grew at a 10.69% average CAGR over this forecast. There are a lot of moving pieces in these catalysts, but if they all take the course and slowly show signs that they will come into fruition, synergies from within Altigen and a resolved litigation conundrum will unearth drastic mispricing. Today, on a comparable basis, Altigen could easily be worth $53 million. Our valuation, built upon a combination of modeled catalyst assumptions, prices the company at $3.13 a share.

*all figures in thousands (except earnings per share)

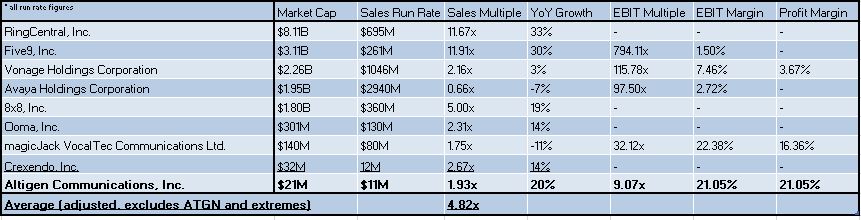

Our conviction is that Altigen is grossly underpriced, and verified this with even more conservative approaches. The company sits on a lot of value. Look at how competitors in the VoIP cloud space are priced.

Most of Altigen’s competitors have stretched valuations and some have no profit (or even no operating profit). Moreover, ATGN has the greatest margins in this pool and trades at the lowest EBIT multiple. On a comparable sales basis, ATGN should trade for $2.34. This still represents an upside of over 150%.

Most of Altigen’s competitors have stretched valuations and some have no profit (or even no operating profit). Moreover, ATGN has the greatest margins in this pool and trades at the lowest EBIT multiple. On a comparable sales basis, ATGN should trade for $2.34. This still represents an upside of over 150%.

A zero-growth valuation still prices ATGN shares within the range of $1.01 - $1.33. In other words, in our most conservative approach, Altigen offers upside between 10 - 43%.

Most importantly, Altigen’s closest comparable, Crexendo, Inc., trades at a higher multiple of sales. Crexendo is also listed on OTC Markets, operates a very similar business, and has substantially more hardware business. Moreover, Crexendo does not even turn a profit even at the operating level. Crexendo’s gross margin is 67.15%, while Altigen’s is 82.87%.

Altigen rounds the bases around Crexendo; and, by comparable standards, should trade for at least $1.30.

Altigen has depressed multiples with regard to growth. The company currently grows faster than any of its competitors (save for the ones who trade in triple-digit EBIT multiple ranges). This is likely attributable to Altigen’s choppy historical growth and litigation issues. If It can sustain growth, now that it has turned the corner with respect to profitability and software/recurring revenue sales mix, we can expect multiple expansion.

What else to like:

- The company has a lot of cash on the books, nearly five million. Not only does this cover any remaining litigation payouts, it frees up spending for any future capex.

- The majority of margin is spent in operations, specifically R&D. Money can hit the bottom line, and this is a scalable business with recurring revenue.

- In 2018, EBIT grew from 382 thousand dollars to over 1.1 million. After the fiscal year’s end, the current run rate is $2.4 million. As shown in the table above, Altigen trades about 9x EBIT.

- Backing out a run rate for net income, the company has a 15.70% adjusted return on invested capital. Our weighted cost of capital is 7.07%. Altigen generates more return on capital than it incurs cost in running the business

- In Q1 2019, recurring revenues contributed to 81% of overall revenue.

Risks

- Risk of Azure – alternatives to Azure service providers and Azure itself

- Competition

- There is no barrier to entry

- Litigation reoccurrences

- Risks in the business also include distribution contracts and customer satisfaction.

Distribution agreements with Synnex Corporation and Altysis Communications, Inc. are renewable each year, subject their discretion. Moreover, a ten-year contract with Fiserv Solutions ends in August of this year. Fiserv retains discretion to continue this contract for another five years. Last year, the Fiserv partnership accounted for nearly 25% of Altigen’s revenue. These partnerships have served Altigen very well; much of the marketing burden is relieved.

Is this a company that can display astronomical growth? Maybe not

But what this can be is a stable, growing business with potential for an extended and moderate growth cycle. This company is software with a purpose. It is not just an add on product, it is a logistical solution for enterprises and their communication needs. If catalysts come into fruition, value creation will be immense.