Introduction

I think Issuer Direct is a simple investment thesis. $ISDR is a US microcap that is growing rapidly, but whose growth is being masked by declining legacy segments. Once the growth business overtakes the declining businesses, the results will show on their financial statements and significant capital appreciation should be expected.

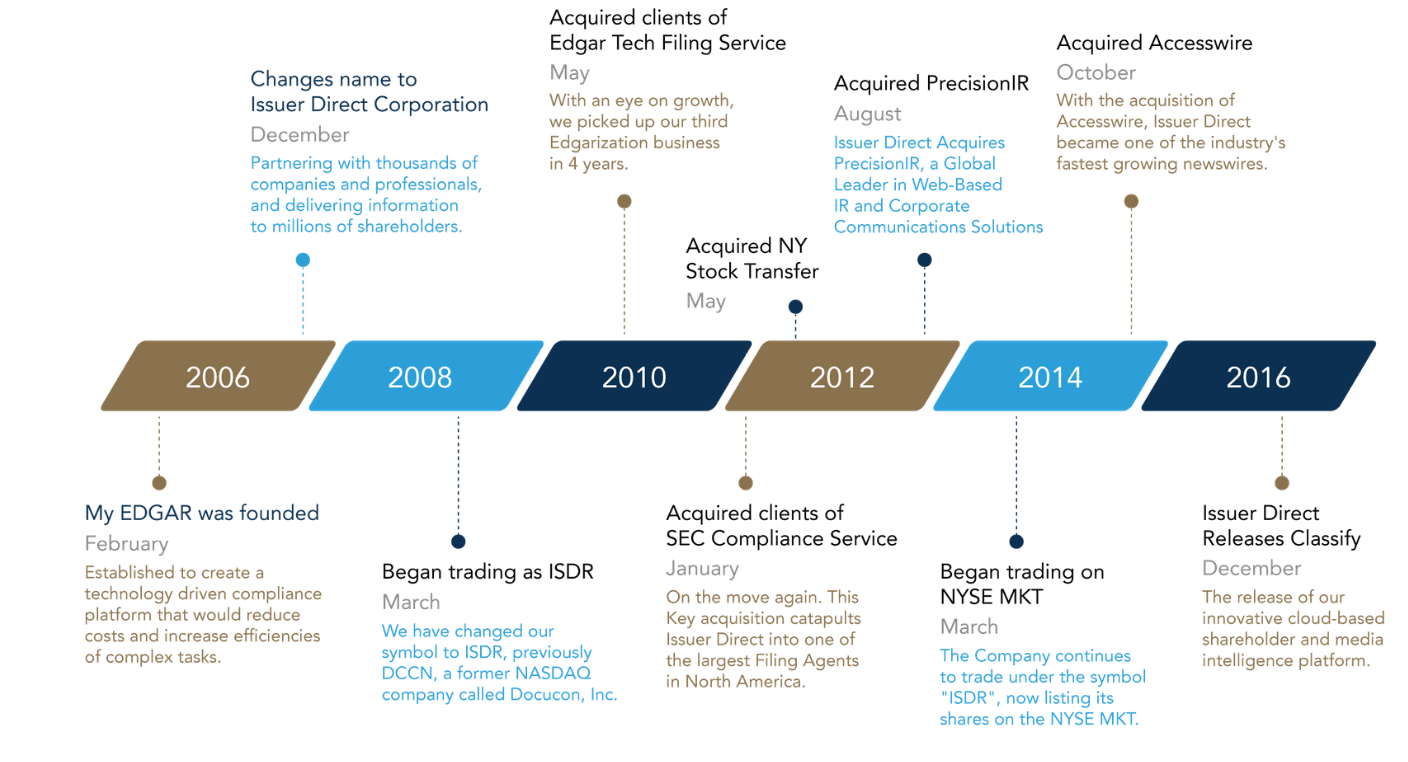

First, a quick history of the company. It was founded in 2006 by the current CEO and has grown rapidly through new product offerings and strategic acquisitions. Below is a time line on the company’s website.

Many microcap investors may have heard of this company or should at least heard of one of the many services provided by ISDR such as Accesswire. If you’ve ever browsed news filings and you see a press release provided by Accesswire, well that’s the same Accesswire that ISDR owns.

Other services provided by ISDR are Annual Report service, earnings event service, such as teleconferencing, webcast, and a bunch of shareholder disclosure and compliance services. In other words, if you’re a public company or a mutual fund, ISDR has everything you need to help you remain in compliance and disclose all necessary info needed to your stakeholders.

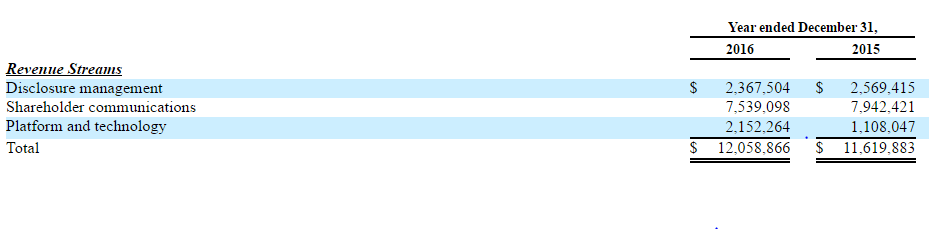

ISDR report product and service revenue in three streams:

- Disclosure management

- Shareholder communications

- Platform and technology

Disclosure business consists of traditional document conversion, typesetting and pre-press design services, XBRL tagging services, and the issuance of securities as it relates to our stock transfer business. These services represent disclosure offerings that are regulated by the Securities and Exchange Commission.

The Shareholder communications segment includes Press Release Distribution which is done through Accesswire, acquired on October 29, 2014, Investor outreach and engagement, webcasting, and proxy.

The Platform and Technology primarily consist of Blueprint, a cloud based document conversion, editing and filing platform for corporate issuers seeking to insource the document drafting, editing and filing processes, and Classify, a buy-side, sell-side and media targeting database and intelligence platform. As more clients transition to their cloud platforms, ISDR expects to see revenue decline in their legacy business, but since the cloud offerings have a higher margin, their financials should improve.

Financials

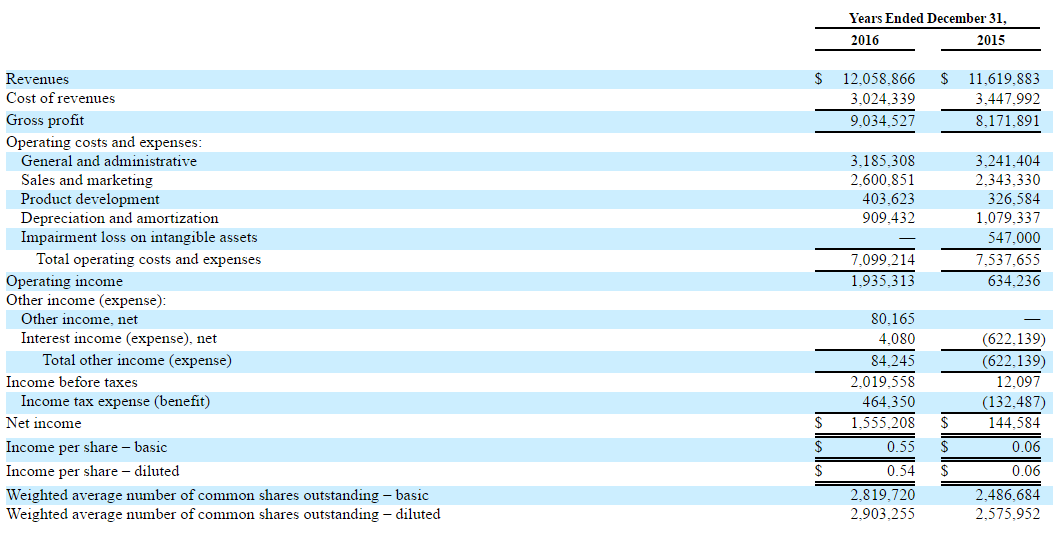

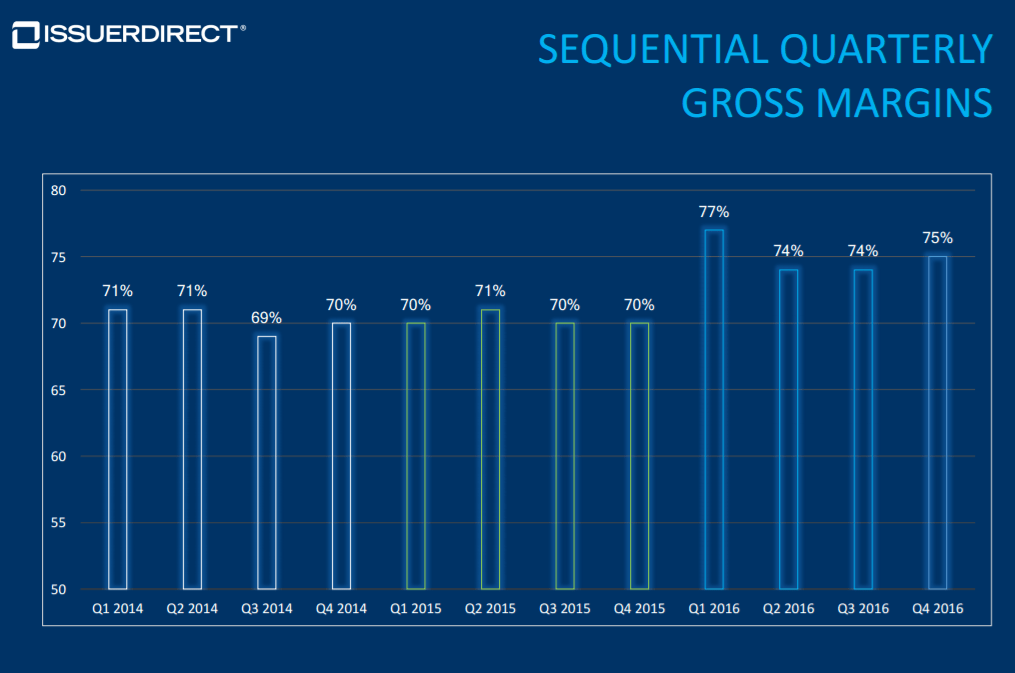

The revenue growth from fiscal 2015 to 2016 wasn’t much, but you can see that because of higher margin products, gross profit increased which led to a 9x increase in EPS.

Breaking down revenue further, you can see that the Platform segment increased by close to 100%. While shareholder communications revenue declined, Accesswire which is included in shareholder communication segment experienced an 60% revenue growth in 2016.

From their year end 2016 earnings press release, the company stated that

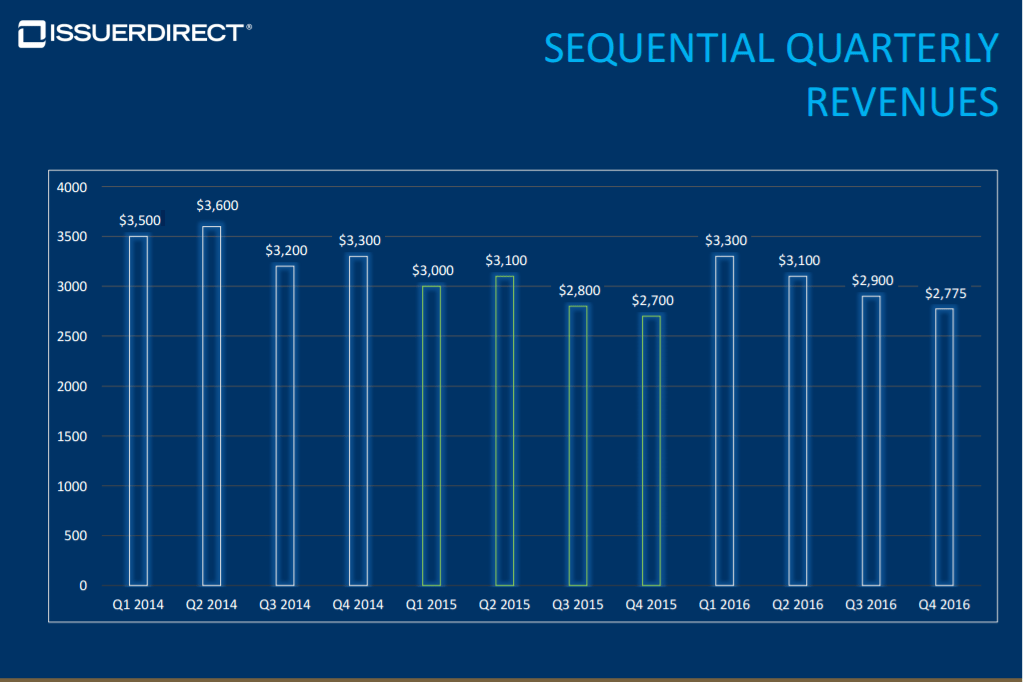

“We are pleased with our quarterly and annual performance. Our Accesswire and platform and technology businesses increased 12% and 18%, sequentially in Q4, respectively. Combined, these areas accounted for 43% of total revenue in the fourth quarter, up from 36% in Q3 and 26% last year. Our goal is to make this 50% by mid-2017. Strong growth in these businesses fueled gross margin expansion to 75% for the year and quarter, up from 70% in both periods last year. EBITDA margins also benefited, increasing to 26% for the year, up from 20% last year, with total annual EBITDA growing 36% year over year. Our focus in 2017 will be on the continued development of our rapidly growing, highly profitable, and scalable Accesswire business and our platform and technology products."

Once these fast growing segments (and sub-segments) are greater than 50% of the company’s revenue, margins and net income growth will accelerate due to the inherent operating leverage in SaaS businesses.

It can be seen above that despite revenues not increasing much year over, gross margins have reached a new level and will continue to improve as long as clients continue migrating to the new platforms.

Management and Insiders

Another huge plus with ISDR is that they happened to be managed by an owner operator, Brian Balbirnie, who founded the company back in 2006. He has a lot of operational experience in this industry prior to ISDR’s founding. He currently holds a 22% stake which is about ~$6.5 million at the current market cap ($34 million). His current salary is a modest $185,000 which is not high at all for a company this size.

It should also be noted that the director of the audit committee David Sandberg of Red Oaks Capital holds about 23% of the total shares, so insiders as a group owns 57.8% of total shares. Then there’s Yorkmont Capital that holds 8% of common shares.

For those of you who like low float stocks, there are only 2.73 million shares outstanding and since insiders own over half of all shares, the float is about 950,000 which is one of the lowest I’ve seen in a while!

Conclusion

ISDR has many of the characteristics of winning microcaps such as an owner operator, high growth, operating leverage, and low float. Projecting financials is quite difficult because of all the different revenue streams and sometimes. Furthermore, the legacy revenue may decline faster or slower than the platform revenues. However, I have a lot of confidence that ISDR will make substantial improvements in its financials in 2 years with upside of at least 50% at the current price ($11.80).

DISCLAIMER: GeoInvesting has no affiliation with the author of this report in any way and is not endorsing his research, nor has GeoInvesting vetted this information in any way. The GeoTeam does not attest to the accuracy of the information contained in this report and always urges investors to conduct their own due diligence. The GeoTeam has received no compensation for the dissemination of this report. The GeoTeam may or may not have a position in any stocks mentioned in this article prior to its publication.