**Stock We’re Tracking

$HBP ($4.38) together with its subsidiaries, distributes millwork, building materials, and wood products for new residential construction, home improvement, remodeling, and repair work in the United States. (middleman between suppliers and end customers)

Reasons For Tracking HBP

| |

2015 |

2014 |

2013 |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Sales |

$659.6 |

$623.7 |

$561.5 |

$521.1 |

$479.3 |

$467.7 |

$455.2 |

$671.0 |

$874.8 |

$1.1B |

|

EPS (1) |

$0.56 |

$0.31 |

$0.20 |

$0.03 |

-$0.57 |

-$0.81 |

-$0.91 |

-$1.64 |

$0.06 |

-$0.40 |

|

EPS (2) |

$0.36 |

$0.20 |

$0.13 |

$0.02 |

-$0.57 |

-$0.81 |

-$0.91 |

-$1.64 |

$0.04 |

-$0.40 |

-

Non-GAAP EPS: (2) Fully taxed EPS

Here is an interesting stat from the company’s 2015 10k

“New housing activity in the United States has shown modest improvement each year since 2009, the trough period of the recent housing downturn. However, 2015 activity was still below the historical average of total housing starts from 1959 to 2015 of approximately 1.4 million starts based on statistics tracked by the U.S. Census Bureau (“Historical Average”). Total new housing starts in the United States were approximately 1.1 million, 1.0 million and 0.9 million in 2015, 2014 and 2013, respectively. Single family starts were 0.7 million, 0.6 million and 0.6 million in 2015, 2014 and 2013, respectively, based on data from the U.S. Census Bureau. According to the U.S. Census Bureau, total spending on new single family residential construction was $219 billion, $194 billion and $171 billion in 2015, 2014 and 2013, respectively.”

-

It appears that HBP fills a void in the housing construction/home remodeling industry. Acting as a middleman between suppliers of building material and customers, specifically, (contractors, dealers, home retail centers), the company is able to save its customers money by being able to purchase in bulk, explore sourcing avenues, and take on customer service duties. More from the 10-K:

We service large local, regional and national independent building products dealers, specialty dealers, and home centers who in turn sell to contractors, professional builders, and consumers. These large local, regional and national building products dealers, often referred to as “pro dealers,” continue to distribute a significant portion of the residential building materials sold in the United States. These pro dealers operate in an increasingly competitive environment. Consolidation among building products manufacturers favors distributors that can buy in bulk and break down large production runs to specific local requirements. In addition, increasing scale and sophistication among professional builders and contractors places a premium on pro dealers that can make a wide variety of building products readily available at competitive prices. In response to the increasingly competitive environment for building products, many pro dealers have either consolidated or formed buying groups in order to increase their purchasing power and/or service levels.

We service the national home centers through special order programs of branded products in both millwork and building products. These programs continue to grow each year, as manufacturers develop special order programs through these retailers and utilize our value added service model and broad distribution network to support these programs locally.

We believe the evolving characteristics of the residential building materials distribution industry, particularly the consolidation trend, favor companies like us that operate nationally and have significant infrastructure in place to accommodate the needs of customers across geographic regions. We believe we are the only national distributor of millwork products. Our wide geographic presence, size, purchasing power, material handling efficiencies and investment in millwork services, position us well to serve the needs of the consolidating pro

We conduct our business through a two-step distribution model. This means we resell the products we purchase from manufacturers to our customers, who then sell the products to the final end users, who are typically professional builders and independent contractors engaged in residential construction and remodeling projects, or consumers engaged in do-it-yourself remodeling projects.

Our products fall into three categories: (i) millwork, which includes doors, windows, moulding, stair parts and columns, (ii) general building products, which include composite decking, connectors, fasteners, housewrap, roofing products and insulation, and (iii) wood products, which include engineered wood products, such as floor systems, as well as wood panels and lumber.

Doors and engineered wood products often require an intermediate value added service between the time the product leaves the manufacturer and before it is delivered to the final customer. We perform such services, on behalf of our customers, which include pre-hanging exterior and interior door units, prefinishing exterior door units and cutting engineered wood products from standard lengths to job-specific requirements. In addition, with respect to the majority of our products, we have the capability to buy in bulk and disaggregate these large shipments to meet individual customer stocking requirements. For some products, we carry a depth and breadth of products that our customers cannot reasonably stock themselves. Our customers benefit from our business capabilities because they do not need to invest capital in door hanging facilities or cutting equipment, nor do they need to incur the costs associated with maintaining large inventories of products. Our size, broad geographic presence, extensive fleet and logistical capabilities enable us to purchase products in large volumes at favorable prices, stock a wide range of products for rapid delivery and manage inventory in a reliable, efficient manner.

We serve our customers, whether they are a local dealer or a national account, through our 26 wholesale distribution centers. Our broad geographic footprint enables us to work with our customers and suppliers to ensure that local inventory levels, merchandising, purchasing and pricing are tailored to the requirements of each market. Each distribution center also has access to our single-platform nationwide inventory management system. This provides the local manager with real-time inventory availability and pricing information. We support our distribution centers with credit and financial management, training and marketing programs and human resources expertise. We believe that these distribution capabilities and efficiencies offer us a competitive advantage as compared to those of many local and regional competitors.

A Seeking Alpha article commented on the stock’s depressed valuation when the stock was trading at ~$3.20.

“Huttig's depressed valuation is a function of its sub-$100mm market capitalization, limited trading liquidity, and lack of attention from the sell-side. However, a rapidly improving earnings trajectory will improve the Company's screening metrics, thereby initiating the virtuous circle of increased attention, improved trading liquidity, an increasing market capitalization, and additional marginal buyers.”

Caveats

-

Low margins are a common characteristic of middleman type of business model. With pretax margins at 1.8%, HBP is no exception.

-

We would like to get a better understanding of the steps management took to improve profitability and if further margin improvement is in the cards.

-

The stock price could experience volatility associated with monthly” housing starts” data.

-

The Company has three labor unions contracts covering 8% of its employees which will require negotiations in 2016.

-

We need to take a closer look at debt covenants liability:

“We are party to a $160.0 million asset based senior secured revolving credit facility which contains a minimum fixed charge coverage ratio (“FCCR”) that is tested if our excess borrowing availability, as defined in the facility, reaches an amount in the range of $12.5 million to $20.0 million depending on our borrowing base at the time of testing. For the year ended December 31, 2015, our FCCR exceeded our threshold of 1:05:1.0. However, if in the future we failed to meet the required FCCR and we were unable to maintain excess borrowing availability of more than the applicable amount in the range of $12.5 million to $20.0 million, our lenders would have the right to terminate the loan commitments and accelerate the repayment of the entire amount outstanding under the credit facility. Our lenders also could foreclose on our assets that secure our credit facility. In that event, we would be forced to seek alternative sources of financing, which may not be available on terms acceptable to us or at all.”

If housing starts flatten out in an increasing interest rate environment, it is imperative that the company can replace potential lost revenue opportunities, especially in the event that consumers instead choose to implement more home improvements.

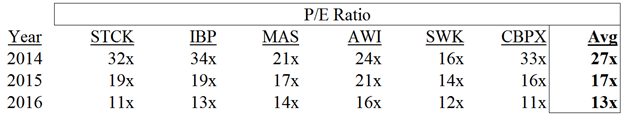

Next, we plan on providing an updated comp chart and our own valuation analysis to take into account current share prices.