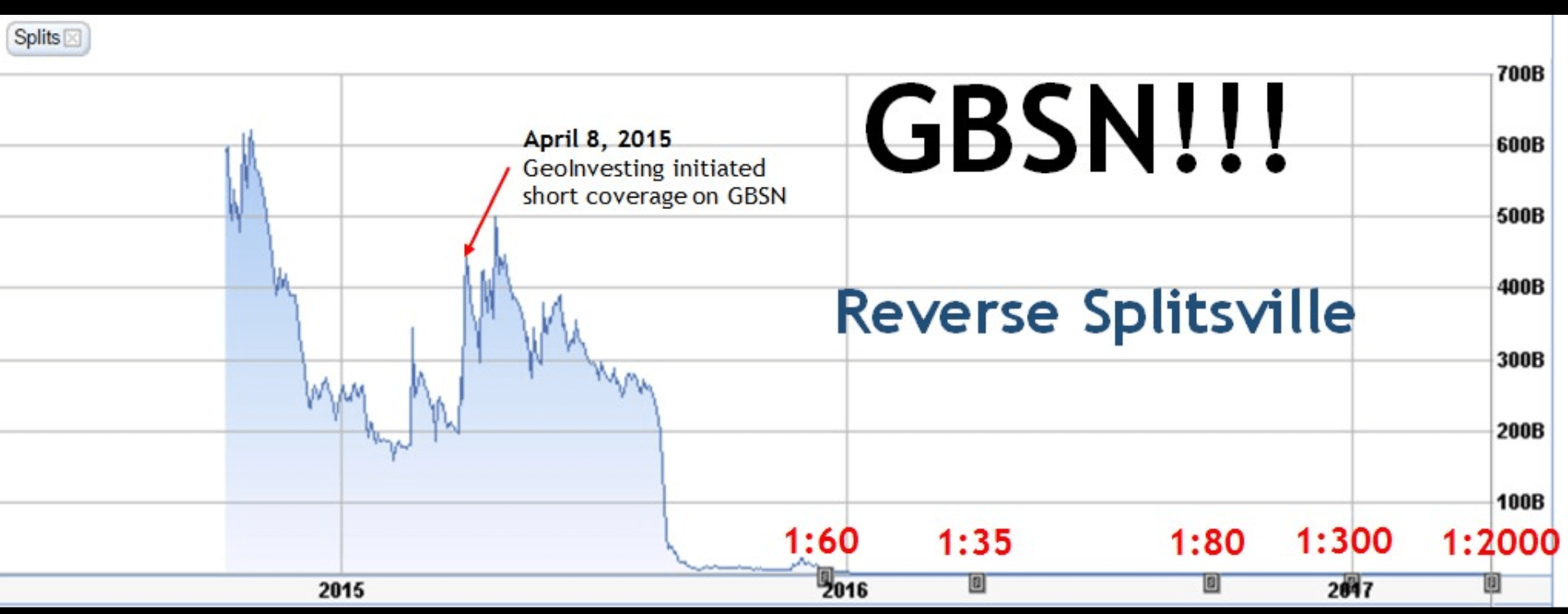

Great Basin Scientific (OTC:GBSN) appears to us to be an ATM machine that is spitting out infinite amounts of money. GBSN has an ugly history of conducting reverse splits and then either performing a financing or refinancing of an existing convertible facility. Since going public in 2014, the stock has been through 5 reverse splits and “rewarded” its investors with the following:

- Raising $138 million in capital

- Generating only $3.05 million in revenue in 2016 (Source: 2016 10-K)

- Sporting an accumulated deficit of $211 million

- A 2016 cash burn rate of at least $30 million

- A net loss of $90 million for 2016

- The 3 top executives paying themselves base salaries of $475 thousand in 2013 vs. $1.0 million in 2016, as shareholder value has been demolished.

For the eternally optimistic, GBSN’s break even at the operating level does not seem to be anywhere close. The company can’t even turn sales into any gross profit. For example, at $8.0 million, 2016 COGS were 2.7x higher than 2016 revenue.

In our opinion management is continuing down a path of destroying shareholder value.

Lenders Losing Confidence?

What recently caught our eye was a February 10, 2017 press release portraying a message that management struck a sweetheart restructuring deal with convertible note (issued in 2016) holders that reduced the principle of these notes from $75 million to $36 million.

“As part of the restructuring plan, Great Basin has streamlined certain manufacturing and administrative processes and will eliminate approximately 50 employees nationwide. Between these changes, along with other previously implemented cost reductions and added efficiencies, the Company expects to remove between $10 million to $12 million from its annual cash burn. The Company also announced today that it has significantly reduced the 2016 Convertible Note to $36 million.”

The 2016 Notes were issued in July 2016 when GBSN raised $68 million. $62 million was placed in restricted accounts and $6 million was immediately available to the Company.

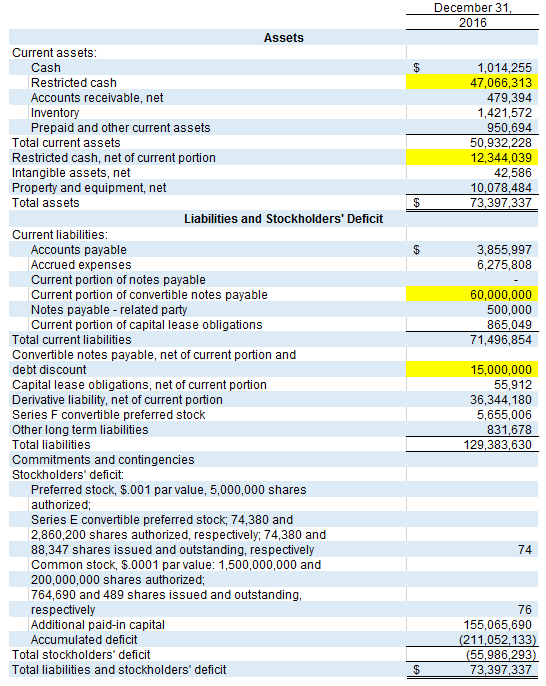

Here is a snapshot of GBSN's balance sheet as of December 31, 2016

What the company did not mention in the February 10 release was that it paid down the 2016 note balance from capital it raised from the issuance of these notes that was placed in restricted cash accounts. However, this information is disclosed in a related 8K and GBSN 2016 10K filed on March 22, 2017.

“The Company will pay the Redemption Price for the Redemption Notes from cash held in the restricted accounts of the Company reducing the amount of cash in the Company’s restricted accounts from $57.0 million to $21.5 million. After the redemption the principal amount of the 2016 Notes will be reduced from $71.8 million to $36.3 million.”

From our research, it seemed that the company was depending on the restricted cash balance being systematically released to fund operations. But up until the note restructure deal, GBSN had only seen $10.3 million released from the restricted account. Basically, what was going on in 2017 was that the principle balance of the notes was being reduced by a formula as note holders converted their notes to equity or by using restricted cash to redeem notes.

Here is an excerpt from the last 8K issued before the February 10 restructure press release discussing the notes:

"As of February 3, 2017, a total principal amount of $3.2 million of the 2016 Notes has been converted into shares of Common Stock. Approximately $71.8 million in principal remains to be converted. Restrictions on a total of $10.3 million in the Company’s restricted cash accounts has been released including $6.0 million at closing and $4.3 million in early release from the restricted cash accounts. $57.7 million remains in the restricted cash accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes."

After sifting through GBSN filings since February 10, it looks like Note Holders have “generously” released another $2.6 million of restricted cash and around $3.0 million more of the restricted cash was used to continue to redeem Note principle.

We calculate that GBSN has no more than $17 million left in its restricted cash account and less than a million, if any in its cash account, compared to a current convertible note balance of between $16 million and $32 million. (We require clearer disclosures to hone on exact balances).

Note that the small difference in note principal on the liability side of the balance sheet and cash on the asset side comes from issuance costs related to the notes and original issue discounts (OID).

Rinse & Repeat

On April 7, 2014, GBSN closed at $0.004 with 1.5 billion shares outstanding. On April 10, GBSN implemented its fifth reverse split since going public.

- Capital Change=shs decreased by 1 for 60 split Ex-date=12/14/2015.

- Capital Change=shs decreased by 1 for 35 split Ex-date=03/31/2016.

- Note = Delisted from Nasdaq on 10-11-2016

- Capital Change=shs decreased by 1 for 80 split Ex-date=09/16/2016.

- Capital Change=shs decreased by 1 for 300 split Pay date=12/28/2016.

- Capital Change=shs decreased by 1 for 2000 split. Pay date=04/10/2017.

This 1 for 2000 reverse split equates to an adjusted April 7 close of $8.00.

It is already down 90% since April 7, having already breached $1.00 per share to the downside. After the reverse split, some data providers are showing that the company has about 1.0 million shares outstanding. However, along with the reverse split, GBSN also renegotiated the terms of outstanding convertible notes and preferred stock.

At the floor conversion terms and using today’s prices, we calculate that GBSN’s fully diluted share count would be about 17 million. Less dilution would occur if GBSN shares were able to pump higher. If you are short GBSN you might want to know that the stock has a history of quick pumps before imploding.

More On The Restricted Cash Balance

Don’t get fooled by the restricted cash balance. As of December 31, 2016 GBSN’s cash balance consisted of $1 million in cash and $59 million in restricted cash. After the recent 2016 note redemption a majority of the restricted cash is gone.

The restricted cash is planned to be released upon the company meeting certain milestones, called equity requirements. We are assuming that the company was unable to meet the equity requirements described in their 10-K.

“If the Company does not meet these equity conditions, then the cash will not become available to the Company. Two of those equity conditions are that the Company’s shares of common stock have a dollar value of daily trading volume of at least $800,000 and a 5-day weighted average price of $31,200 (adjusted for the Company’s reverse stock splits) during certain equity condition measurement periods. The Company obtained a waiver on January 9, 2017, to these equity conditions which extended through February 28, 2017 and has now expired. As of March 17, 2017, the Company’s common stock closed at $0.001 per share and the dollar value of daily trading volume was $17,172.”

This factor likely explains why almost $40m in principal was redeemed by returning cash from the restricted cash balance. We think GBSN is lightyears away from meeting the requirements. The adjusted equity conditions concurrent with the April 10 note restructuring call among other things for:

“the daily dollar trading volume of the Common Stock as reported by Bloomberg for each Trading Day during the period beginning five (5) Trading Days prior to the applicable date of determination and ending on and including the applicable date of determination shall be at least $250,000; (xii) on each Trading Day during the Equity Conditions Measuring Period, the Weighted Average Price of the Common Stock equals or exceeds $0.10 (which price gives effect to the Current Reverse Split but should be adjusted for other stock splits, stock dividends, stock combinations, recapitalizations or similar events occurring after the Exchange Signing Date);”

The new equity conditions, although lowered, seem hard to meet as well.

We find it interesting that the company celebrates the release of relatively small portions of the restricted cash, while in reality a majority of the backup cash was recently withdrawn.

In a second April 10, 2016 release management seems pretty excited about another note restructuring that will give it “immediate access to $800,000 of previously restricted cash and access to an additional $10.8 million in capital through mandatory conversions of the new Series B Notes.” Basically, the company is transferring the 2016 notes and some series F preferred stock to new notes that mature on April 7th 2019. After burning through $30 million in cash, we find little comfort that this “influx” or moving around of capital will stave off imminent capital raises. And as we discuss below, we think management might agree with us on this point.

17 Million Shares Is Just A Mirage

Buried in GBSN 2016 10K filed on March 22, management is basically told the market that it is gearing up for another capital raise fairly soon. In fact, management mentioned that they were going to have to raise capital as the end of March rolled around:

“We have limited liquidity, and have not yet established a stabilized source of revenue sufficient to cover operating costs based on our current estimated burn rate. In order to finance the continued growth in product sales, to invest in further product development and to otherwise satisfy obligations as they mature, we will need to seek additional financing through the issuance of common stock, preferred stock, and convertible or non-convertible debt financing.

Our independent registered public accounting firm has included an explanatory paragraph raising substantial doubt about our ability to continue as a going concern in its report on our audited financial statements. We may be unable to continue to operate without the threat of liquidation for the foreseeable future unless we raise additional capital.

In February 2017, we filed a registration statement with the Securities and Exchange Commission for an offering of equity securities, which we anticipate closing by the end of March 2017. In the event we complete such offering, along with additional funds to be withdrawn from our restricted cash accounts, if we are able to meet the conditions of the 2016 Note or if we are able to negotiate the releases, we believe we will have sufficient cash to fund our planned operations through much of calendar year 2017. We also anticipate we will need to seek additional financing prior to the end of the calendar year to continue funding our operations for the remainder of 2017 and into 2018.”

In the end, we just don’t trust much of what this management team promises. On March 22, 2017 management clearly stated that they would need to tap a registration statement filed in February 2017. But on January 20, 2017, the company filed a Registration Withdrawal Request with regards to plans to raise money per a prospectus dated January 17, 2017…

“The Company requests that the Registration Statement be withdrawn because the Company’s management believes that the financing is no longer necessary to fund the ongoing operations of the Company and, in that case, the Company desires, in the best interests of its shareholders, to avoid a potentially unnecessary dilutive financing. No securities registered pursuant to the Registration Statement have been issued or sold.“

… yet, in our opinion, its 10K issued a couple month later portrays a pretty dire need of capital and that they need to raise capital as part of registration statement that has been withdrawn!!! Talk about “Back to The Future”.

Share Performance And A Look At The Past

It’s easy to see an illustration of the GBSN rinse and repeat cycles when you examine the stock’s performance: here is what the stock has done over the last three years.

As you can see, GBSN continues to asymptote to $0. After each reverse split and each financing or re-financing, the company sinks closer and closer to zero, although never actually touching it.

Regardless of how many shares are issued, this is inescapable dilution looks like it’s going to continue to put pressure on shares and drive the price of GBSN lower. GeoInvesting members and readers may recall when we first pointed out the stock over two years ago, highlighting the toxic and dilutive financings that it was taking on through Dawson James Securities, an investment bank with a questionable track record. At the time, we pointed out the following about GBSN’s primary financiers:

- Given these infractions and Dawson’s association with other stocks we consider to be pump and dumps, we are concerned that Dawson may not be adequately preventing its brokers from participating in pump and dump activities. Furthermore, given that the pump campaign on GBSN began shortly after its October IPO and its February secondary offering, we are forced to question if Dawson and/or pre IPO/secondary offering investors are behind the alleged campaign to some degree.

- Dawson has had investment banking relationships with four other publicly traded companies (ATOS, SIBE, AMPD, BHRT) that we classify as pump and dumps (supported by promotional emails from newsletters). Three are trading for pennies. All are trading well below the prices from which respective pump campaigns commenced.

- Dawson was one of the underwriters of the IPO of Fuqi International,Inc (FUQI). FUQI was a high profile U.S. Chinese Company accused of fraud, and subsequently got halted, delisted and had its registration revoked.

Over the last couple of years, nothing has changed and the company continues to perform these types of ugly transactions that are devastating to shareholder value.

With no signs of GBSN stopping its dilutive toxic financing spiral, we believe shares to be an ATM that will continue to pay-off for risky short sellers unless the unlikely occurs and the company is able to generate cash on its own without toxic financing deals.

APPENDIX

Item 1.01 Entry into a Material Definitive Agreement

https://www.sec.gov/Archives/edgar/data/1512138/000156459017000010/gbsn-8k_20170103.htm

On January 2, 2017, Great Basin Scientific, Inc. (the “Company”) entered into separate agreements (each, an “Amendment Agreement”) with holders of more than 51% in aggregate principal amount of the senior secured convertible notes (the “2016 Notes”) issued by the Company pursuant to that certain Securities Purchase Agreement, dated June 29, 2016, by and among the Company and the investors party thereto. Pursuant to the terms of the Amendment Agreements, all of the 2016 Notes were amended such that no holder of 2016 Notes nor any of its affiliates will sell, directly or indirectly, on any trading day more than its pro rata percentage of 40% of the trading volume of our common stock, unless our common stock is then trading above $2.50 (as adjusted for stock splits, stock dividends, recapitalizations and similar events).

https://www.sec.gov/Archives/edgar/data/1512138/000156459017000145/gbsn-8k_20161231.htm

As of January 6, 2017 a total principal amount of $1.4 million of the 2016 Notes has been converted into shares of common stock. The amount equal to the number of shares issued during the pre-installment period multiplied by the conversion price in effect at the installment date of January 30, 2017 is not subject to deferral to future periods. Approximately $73.6 million in note principal remains to be converted. A total of $8.6 million of the proceeds from the 2016 Notes has been released to the Company including $6.0 million at closing and $2.6 million in early release from the restricted cash accounts. $59.4 million remains in the restricted accounts to be released to the Company at future dates pursuant to terms of the 2016 Notes.

As of January 6, 2017 there are 1,302,904 shares of common stock issued and outstanding (adjusted for the recent reverse stock split effective December 28, 2016)

Item 3.02 Unregistered Sales of Equity Securities

https://www.sec.gov/Archives/edgar/data/1512138/000156459017000338/gbsn-8k_20170109.htm

On January 9 through January 12, 2017, certain holders of the 2016 Notes were issued shares of the Company’s common stock pursuant to Section 3(a)(9) of the United States Securities Act of 1933, (as amended) in connection with the pre-installment amount converted for the installment date of January 30, 2017. In connection with the pre-installments, the Company issued 225,000 shares of common stock upon the conversion of $570,060 principal amount of 2016 Notes at a conversion price of $2.53 per share (adjusted for the recent reverse stock split effective December 28, 2016).

As of January 13, 2017 a total principal amount of $2.0 million of the 2016 Notes has been converted into shares of common stock. The amount equal to the number of shares issued during the pre-installment period multiplied by the conversion price in effect at the installment date of January 30, 2017 is not subject to deferral to future periods. Approximately $73.0 million in note principal remains to be converted. A total of $8.6 million of the proceeds from the 2016 Notes has been released to the Company including $6.0 million at closing and $2.6 million in early release from the restricted cash accounts. $59.4 million remains in the restricted accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes.

As of January 13, 2017 there are 1,527,904 shares of common stock issued and outstanding (adjusted for the recent reverse stock split effective December 28, 2016).

https://www.sec.gov/Archives/edgar/data/1512138/000114420417002988/v457259_8k.htm

Pursuant to the terms of the Amendment Agreement, Section 8 of the Notes, which contained the provisions of the 2016 Notes dealing with installment payments, the Company’s ability to elect to convert installment payments, delivery of pre-installment conversion shares in relation to converted installment payments and the ability of Noteholders to accelerate or defer installment amounts was eliminated and any reference to any defined terms appearing elsewhere in the 2016 Notes that related solely to Section 8 and that were not otherwise used in the 2016 Notes were deleted. Any pre-installment conversion shares received by any holder of 2016 Notes with respect to which the related installment date has not yet occurred as of the date of Amendment Agreement and which shall not occur as a result of the Amendment Agreement, immediately reduce the principal amount of the 2016 Notes outstanding by $0.044 per a pre-installment conversion share so received.

https://www.sec.gov/Archives/edgar/data/1512138/000114420417002989/v457257_rw.htm

The Company requests that the Registration Statement be withdrawn because the Company’s management believes that the financing is no longer necessary to fund the ongoing operations of the Company and, in that case, the Company desires, in the best interests of its shareholders, to avoid a potentially unnecessary dilutive financing.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017000472/gbsn-8k_20170120.htm

As of January 20, 2017 a total principal amount of $609,235 of the 2016 Notes has been converted into shares of common stock. Approximately $74.4 million in note principal remains to be converted. Restrictions on a total of $9.8 million in the Company’s restricted cash accounts has been released including $6.0 million at closing and $3.8 million in early release from the restricted cash accounts. $58.2 million remains in the restricted cash accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017000480/gbsn-8ka_20170123.htm

As of January 20, 2017 a total principal amount of $626,853 of the 2016 Notes has been converted into shares of common stock. Approximately $74.4 million in note principal remains to be converted. Restrictions on a total of $9.8 million in the Company’s restricted cash accounts has been released including $6.0 million at closing and $3.8 million in early release from the restricted cash accounts. $58.2 million remains in the restricted cash accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017000621/gbsn-8k_20170125.htm

As of January 25, 2017 a total principal amount of $2.1 million of the 2016 Notes has been converted into shares of common stock. Approximately $72.9 million in note principal remains to be converted. Restrictions on a total of $9.8 million in the Company’s restricted cash accounts has been released including $6.0 million at closing and $3.8 million in early release from the restricted cash accounts. $58.2 million remains in the restricted cash accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017000700/gbsn-8k_20170126.htm

As of January 27, 2017 a total principal amount of $2.3 million of the 2016 Notes has been converted into shares of common stock. Approximately $72.7 million in note principal remains to be converted. Restrictions on a total of $9.8 million in the Company’s restricted cash accounts has been released including $6.0 million at closing and $3.8 million in early release from the restricted cash accounts. $58.2 million remains in the restricted cash accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes.

https://www.sec.gov/Archives/edgar/data/1512138/000114420417005482/v458199_8k.htm

On February 2, 2017, the 2016 Note Buyers voluntarily agreed to remove restrictions on the Company’s use of an aggregate of approximately $0.5 million in cash previously funded to the Company and authorized the release of those funds from the restricted accounts of the Company for each 2016 Note Buyer in accordance with that certain Master Control Account Agreement previously entered into by and among the Company, UBS Financial Services Inc. and the collateral agent.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017000971/gbsn-8k_20170130.htm

As of February 3, 2017, a total principal amount of $3.2 million of the 2016 Notes has been converted into shares of Common Stock. Approximately $71.8 million in principal remains to be converted. Restrictions on a total of $10.3 million in the Company’s restricted cash accounts has been released including $6.0 million at closing and $4.3 million in early release from the restricted cash accounts. $57.7 million remains in the restricted cash accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes.

https://www.sec.gov/Archives/edgar/data/1512138/000114420417007227/v458872_8k.htm

On February 9, 2017, the Company and each of the 2016 Note Buyers entered into separate agreements (each, an “Note Redemption Agreement”), pursuant to which the Company agreed to redeem, in the aggregate, $35.6 million of the 2016 Notes (the “Redemption Notes”) held by the 2016 Note Buyers for an aggregate redemption price of $35.6 million (the “Redemption Price”). The Company will pay the Redemption Price for the Redemption Notes from cash held in the restricted accounts of the Company reducing the amount of cash in the Company’s restricted accounts from $57.0 million to $21.5 million. After the redemption the principal amount of the 2016 Notes will be reduced from $71.8 million to $36.3 million.

In addition, the holders of the 2016 Notes also voluntarily removed restrictions on the Company’s use of an aggregate of approximately $650,000 previously funded to the Company and authorized the release of those funds from the restricted accounts of the Company

https://www.sec.gov/Archives/edgar/data/1512138/000114420417007228/v458871_ex99-1.htm

Salt Lake City, February 10, 2017 – Great Basin Scientific, Inc. (OTCQB: GBSN), a molecular diagnostics company, today announced a restructuring and cost reduction plan that is designed to focus Company resources on areas that accelerate the revenue growth of its current commercial product line. As part of the restructuring plan, Great Basin has streamlined certain manufacturing and administrative processes and will eliminate approximately 50 employees nationwide. Between these changes, along with other previously implemented cost reductions and added efficiencies, the Company expects to remove between $10 million to $12 million from its annual cash burn. The Company also announced today that it has significantly reduced the 2016 Convertible Note to $36 million.

https://www.sec.gov/Archives/edgar/data/1512138/000114420417009611/v459811_8k.htm

feb 16, 2017, the Company and one of the 2016 Note Buyers entered into an agreement (the “Note Redemption Agreement”), pursuant to which the Company agreed to redeem $2,011,170 of the 2016 Note (the “Redemption Note”) held by such 2016 Note Buyer for an aggregate redemption price of $2,011,170 (the “Redemption Price”), which will satisfy such Redemption Note in full. The Company will pay the Redemption Price for the Redemption Notes from cash held in the restricted accounts of the Company. After the redemption, the principal amount of the remaining 2016 Notes will be reduced from $36.0 million to $33.9 million.

https://www.sec.gov/Archives/edgar/data/1512138/000114420417009693/v459924_8ka.htm

On February 16, 2017, the Company and one of the 2016 Note Buyers entered into an agreement (the “Note Redemption Agreement”), pursuant to which the Company agreed to redeem $1,729,920 of the 2016 Note (the “Redemption Note”) held by such 2016 Note Buyer for an aggregate redemption price of $1,729,920 (the “Redemption Price”), which will satisfy such Redemption Note in full. The Company will pay the Redemption Price for the Redemption Notes from cash held in the restricted accounts of the Company. After the redemption, the principal amount of the remaining 2016 Notes will be reduced from $36.0 million to $34.3 million.

https://www.sec.gov/Archives/edgar/data/1512138/000114420417009710/v459937_8k.htm

As of February 16, 2017, a total principal amount of $3.5 million of the 2016 Notes has been converted into shares of Common Stock. Approximately $34.3 million in principal remains to be converted. Restrictions on a total of $11.0 million in the Company’s restricted cash accounts has been released including $6.0 million at closing and $5.0 million in early releases from the restricted cash accounts. $19.7 million remains in the restricted cash accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017002436/gbsn-8k_20170210.htm

As of February 24, 2017, a total principal amount of $3.8 million of the 2016 Notes has been converted into shares of Common Stock. Approximately $33.9 million in principal remains to be converted. Restrictions on a total of $11.0 million in the Company’s restricted cash accounts has been released including $6.0 million at closing and $5.0 million in early releases from the restricted cash accounts. $19.7 million remains in the restricted cash accounts to have the restrictions removed and become available to the Company at future dates pursuant to terms of the 2016 Notes.

On March 1, 2017, the 2016 Note Buyers voluntarily agreed to remove restrictions on the Company’s use of an aggregate of approximately $1.1 million in cash previously funded to the Company and authorized the release of those funds from the restricted accounts of the Company for each 2016 Note Buyer in accordance with that certain Master Control Account Agreement previously entered into by and among the Company, UBS Financial Services Inc. and the collateral agent.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017003158/gbsn-8k_20170302.htm

On March 1, 2017, the Company and one of the 2016 Note Buyers entered into an agreement (the “Note Redemption Agreement”), pursuant to which the Company agreed to redeem $430,621 of the 2016 Note (the “Redemption Note”) held by such 2016 Note Buyer for an aggregate redemption price of $430,621 (the “Redemption Price”), which will satisfy such Redemption Note in full. The Company will pay the Redemption Price for the Redemption Notes from cash held in the restricted accounts of the Company. After the redemption, the principal amount of the remaining 2016 Notes will be reduced from $33.8 million to $33.4 million.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017003343/gbsn-8k_20170227.htm

On March 3, 2017, the Company and one of the 2016 Note Buyers entered into an agreement (the “Note Redemption Agreement”), pursuant to which the Company agreed to redeem $1,176,197 of the 2016 Note (the “Redemption Note”) held by such 2016 Note Buyer for an aggregate redemption price of $1,176,197 (the “Redemption Price”), which will satisfy such Redemption Note in full. The Company will pay the Redemption Price for the Redemption Notes from cash held in the restricted accounts of the Company. After the redemption, the principal amount of the remaining 2016 Notes will be reduced from $33.4 million to $32.2 million.

https://www.sec.gov/Archives/edgar/data/1512138/000156459017006248/gbsn-8k_20170407.htm

The Noteholders agreed to convert $800,000 in aggregate principal of the Existing Notes (such portion allocated to each Noteholder, such Noteholder’s “Note Conversion Amount”, and such conversion, the “Note Conversion”) into shares of our the Company’s common stock (the “Note Shares”) at a conversion price of $2.00 per share (after giving effect to the Reverse Stock Split (as defined in Item 5.03 below) of the Common Stock.